For Whom the Road Tolls: Part I

Ernest Hemingway’s classic, “For Whom the Bell Tolls,” culminates with a mission to blow up a strategically located piece of infrastructure in order to thwart the advance of a fascist army. In the book, Hemingway explores the concept of interconnectivity from the individual to the state, with the implication that the outcome of Spain’s Civil War would have ramifications much wider than for the Spaniards alone.

Fascinating summary, but what does this have to do with infrastructure? Well, in a word, everything. A critical strategic asset, infrastructure – in its most elemental sense – is about interconnectivity. Infrastructure exists to move goods, people, data, electrons and molecules from point A to point B. Its long-term strategic importance to economies has been studied at length. Indeed, in more recent times, we’ve seen firsthand the economic and social costs of the failure of infrastructure as a result of weather, deferred maintenance or owner negligence.

From the Texas power grid failure to the Flint, Michigan, water crisis, to the Mexico City Metro overpass collapse to the Grenfell Tower fire in West London, the role that infrastructure plays on our quality of life – and the devastation that can result when infrastructure fails – has been front and center in recent years, and is especially top of mind in the U.S. right now, as a massive $1T infrastructure bill makes its way through Congress.

We know infrastructure has societal value in its ability to facilitate the movement of goods, people and services around the world, but how does this translate into economic value? While there are countless ways to quantify infrastructure's economic impact, we'll share two quick examples that offer pretty compelling data points.

- An independent study done for the U.S. Travel Association found that air travel cancellations and delays cost the U.S. economy ~$36 billion per year.

- A recent Citrix study showed that “Born Digital” populations (e.g., skilled, digitally-savvy employees aged 18-40) can drive an extra $1.9 trillion in corporate profits, and those global economies would benefit significantly from investing in digital infrastructure to support these populations.

Given the critical societal importance of infrastructure, both private and public institutions globally have a vested interest in its effective development, construction, operation and maintenance. Although the economic and social benefits of high-quality infrastructure are clear, the potential partnership between public and private players has thus far failed to live up to its potential, particularly in the U.S.

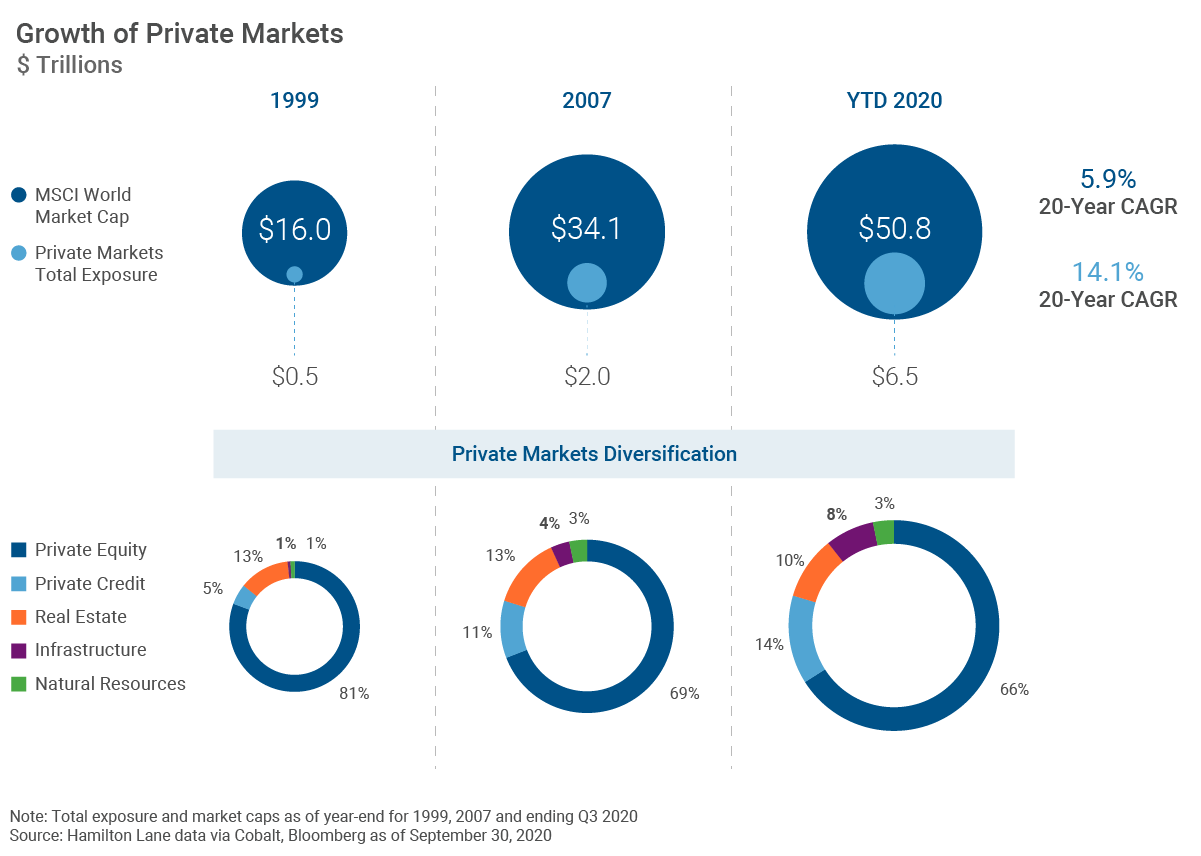

Within the private markets asset class, infrastructure has been one of the fastest-growing subsectors within institutional portfolio allocations over the last 20 years. As shown below, infrastructure, as a percentage of private markets exposure, has grown from 1% of a $500 billion private market exposure in 1999 to 8% of a $6.5 trillion private market exposure in 2020. This represents an addressable infrastructure market in excess of $500 billion, with more than $300 billion available as dry powder to invest in new assets.

Infrastructure

USD in Billions

And while we are seeing private infrastructure investment grow, public spending on infrastructure varies significantly by country. Relative to other global economies, the U.S. has historically spent a significantly smaller share of GDP on infrastructure.

G20 INFRASTRUCTURE INVESTMENT NEEDS

% of GDP, 2016 - 2040

While other developed economies generally spend 3-5% of GDP on infrastructure, the U.S. is projected to invest 1.5%, inclusive of both public and private infrastructure spending. Comparing this figure against the projected investment needs for infrastructure over the same period – and that difference between projected spending and projected requirement results in an investment gap of some $3 trillion. Yes, you read that correctly. As a percentage of the total infrastructure needs, the U.S. infrastructure investment gap is undoubtedly steep relative to developed market peers.

u.s. infrastructure investment needs by infra system

$ Billions, 2020 - 2029 based on Current Trends

Looking across sectors, surface transportation and water infrastructure are projected to have the widest funding gap, and these are two sectors that have historically attracted very little interest from private investors in the U.S. Why is that? In Part II of this series, we'll endeavor to answer just that.

Disclosures

This presentation is not an offer to sell, or a solicitation of any offer to buy, any security or to enter into any agreement with Hamilton Lane or any of its affiliates. Any such offering will be made only at your request. We do not intend that any public offering will be made by us at any time with respect to any potential transaction discussed in this presentation. Any offering or potential transaction will be made pursuant to separate documentation negotiated between us, which will supersede entirely the information contained herein.

Any tables, graphs or charts relating to past performance included in this presentation are intended only to illustrate the performance of the indices, composites, specific accounts or funds referred to for the historical periods shown. Such tables, graphs and charts are not intended to predict future performance and should not be used as the basis for an investment decision.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein.

As of August 11, 2021