Weekly Research Briefing: More to Look Through

Continued economic strength combined with last week's 'hot' CPI figures have sent Treasury yields 30-40 basis points higher over the last two weeks. Equity markets are fine with small doses of rising yields tied to economic upside, but more than that and stock prices begin to get a fear of heights. Especially when the S&P 500 is trading north of 21-times forward earnings. Not helping market jitters were the weekend events in the Middle East. We all hope that calmer heads soon prevail.

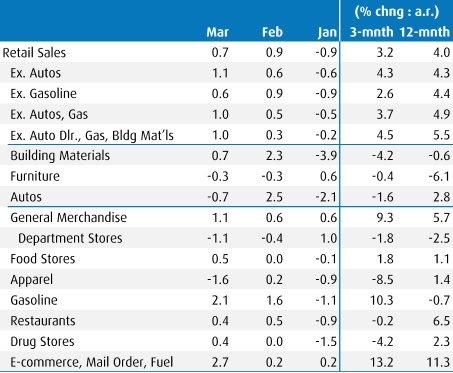

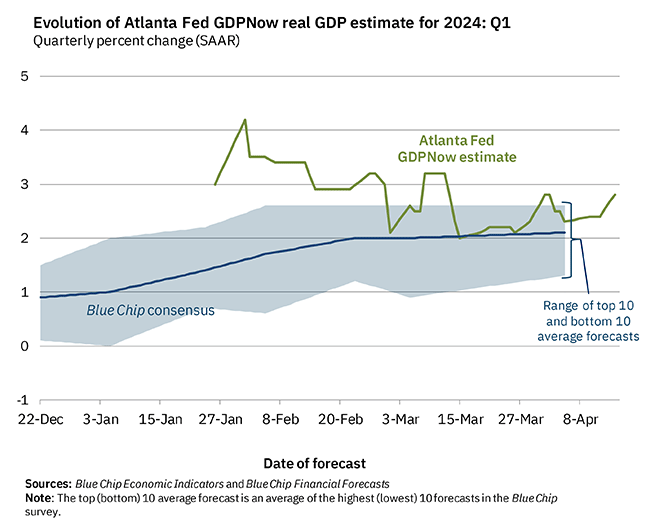

Monday's March retail sales were incredibly strong indicating that the consumer is showing fewer signs of letting down. To quote Sam Ro, "people get jobs --> people have more money --> people spend more --> economy gets bigger --> people get jobs...". The strength in retail sales has led the Atlanta Fed to increase its Q1 GDP estimate to +2.8% which is much stronger than the +1% that most economists were estimating three months ago.

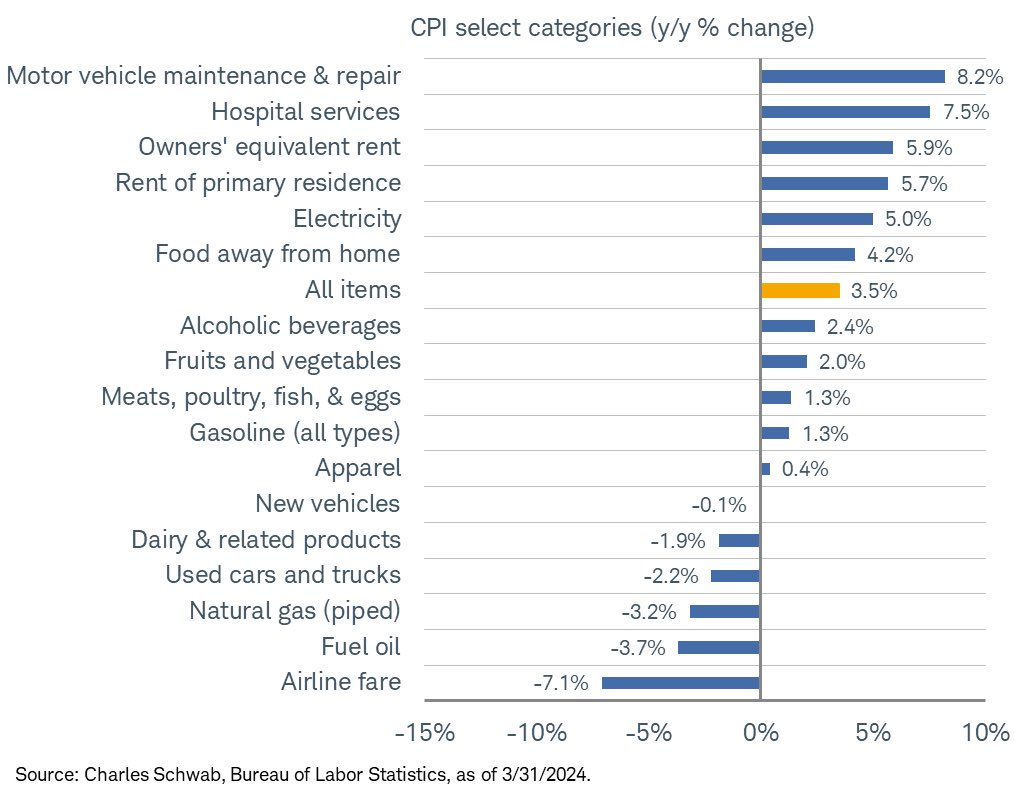

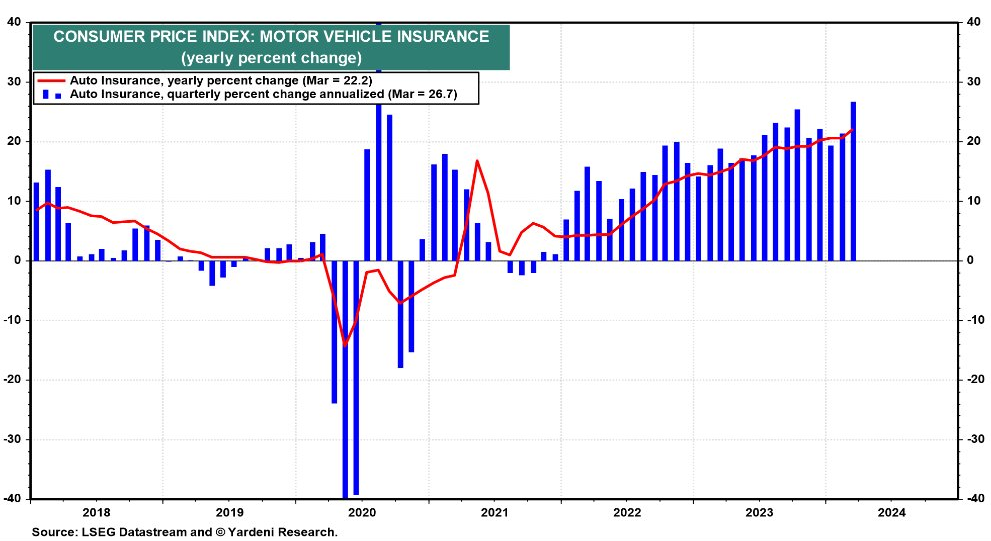

Of course, continued economic strength might be good for Main Street but it is getting under the collar of Wall Street as the headline inflation data remains in an elevated temperature state. The shelter inflation component continues to not cooperate with the many apartment rental and housing price series that price more regularly. And then there is the auto insurance component which this month jumped to a +22% year over year rate. Without these two components, a low 2% inflation target looks on track, but of course we can't ignore the importance of having a car or a roof over our heads.

Earnings should be front and center stage right now, but it has been pushed aside for all of the above issues. The banks started off by printing some solid figures, but with expectations up and a new focus on interest rate volatility, few investors wanted to increase their exposures to the group. This week we will see a ramped release of Q1 numbers with financials making up the majority of companies reporting, but also awaited reports from the airlines, Netflix, United Healthcare and SL Green Realty. Have a great week.

That is a big set of retail sales for March (and even the February upward revision)...

@carlquintanilla: BMO: “.. The March retail sales report shows on-going strength and resilience of the U.S. consumer despite aggressive monetary tightening .. also raises the prospect that U.S. economic growth this year will continue to exceed expectations.”

If you follow Costco, then you knew that March U.S. retail sales would be very strong...

"Net sales for March came in at $23.48 billion, an increase of 9.4% from $21.46 billion last year. This year's retail month of March was impacted by the shift in the timing of Easter. The shift positively impacted total and comparable sales by approximately 0.5%. Reported comparable sales for March were as follows: in the U.S., it was at 7.3%; Canada, 8.9%; Other International, 8.6%; total company, 7.7%; and E-commerce, 28.3%" - Costco IR VP David Sherwood

The consumer has its wallet out and it is looking to spend at retail and airports...

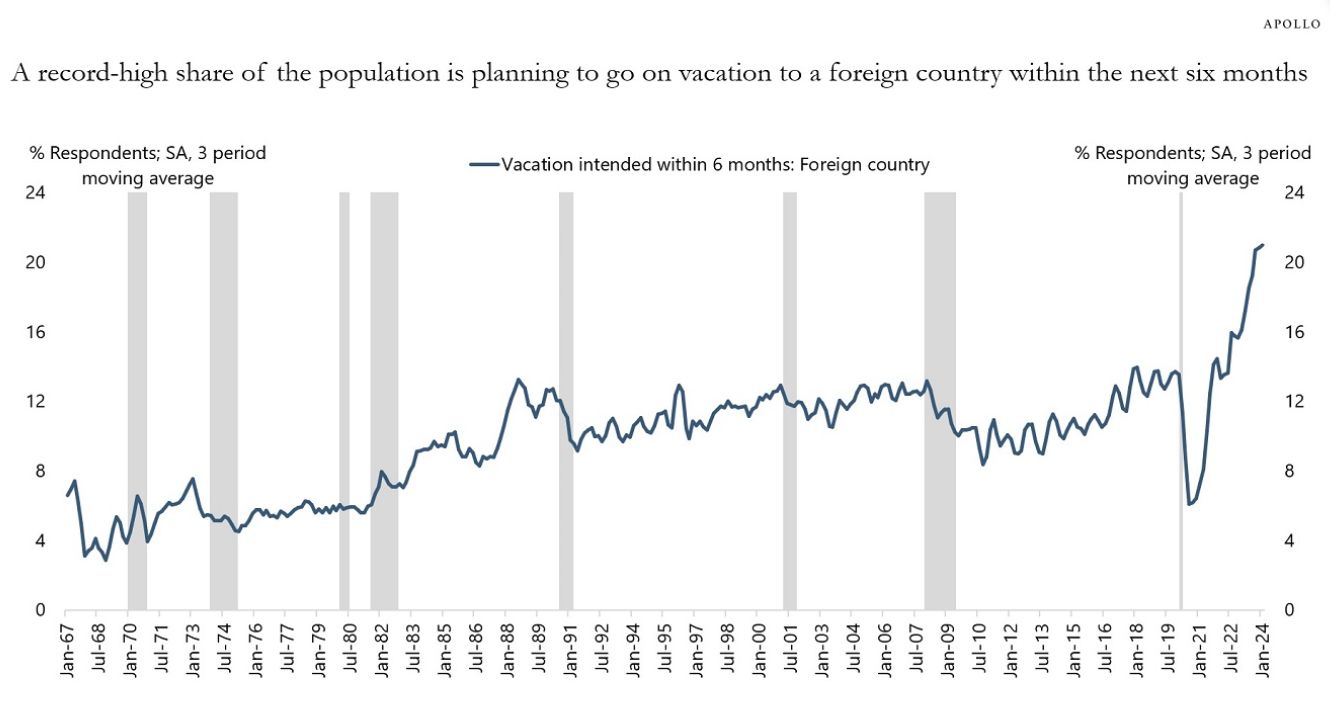

The Conference Board’s consumer confidence survey asks households if they plan to travel to a foreign country, and the chart below shows that a record-high share of US consumers are planning to go on vacation to a foreign country within the next six months.

Because of the significant rise in the stock market and significant cash flows from fixed income, US households have more money to travel on airplanes, stay at hotels, eat at restaurants, go to sporting events, amusement parks, and concerts, and that is why inflation in the non-housing service sector continues to be so high.

Delta Airlines sees records happening this spring and summer...

"Demand continues to be strong, and we see a record spring and summer travel season with our 11 highest sales days in our history, all occurring this calendar year. Spending on services recently to pass goods for the first time in 5 years, and there is further runway to return to their long-term trends" - Delta Airlines CEO Ed Bastian

It looks like Q1 GDP will be coming in close to 3% after the most recent adjustments...

The Growth vs. Inflation teeter-totter is in full play right now...

@alexandraandnyc: Bank of America: "If inflation is sticky because of momentum in the economy, that's not necessarily bad for stocks."

Last week's CPI data would look fine if only we could chop off the highest four items...

@LizAnnSonders

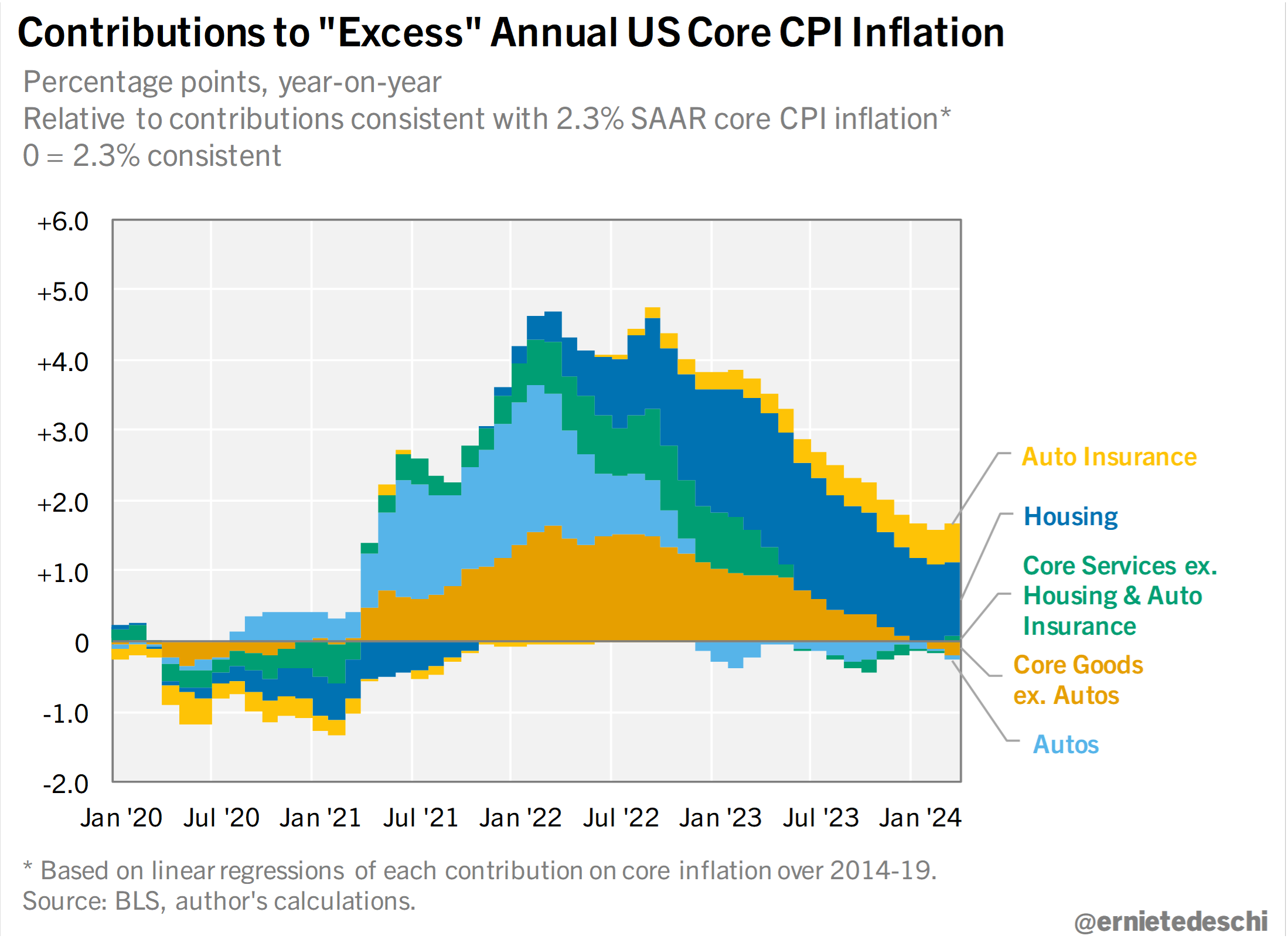

Housing and Auto Insurance are causing the extreme excess inflation right now...

@ernietedeschi: The "excess" core CPI inflation right now is much less broad than what we saw in 2022. In 2022, inflationary pressures hit many categories. In contrast, right now, only two are stronger than we'd expect under 2% PCE pre-pandemic: housing--the lion's share--and auto insurance.

UBS' CIO continues to see many signs of deflation...

Inevitably markets reacted to US consumer price inflation headlines, but the details did matter. There is very strong evidence against inflation stickiness. Aside from rents and fictitious owners’ equivalent rents, there is deflation in almost every consumer price subcategory somewhere in the US. With collapsing clothing prices in Tampa or plunging communication prices in Chicago, it is difficult to argue that structural inflation stickiness exists when every key sector has deflation somewhere in the country.

Here is a graph of the auto insurance rate break out...

@Yardeni

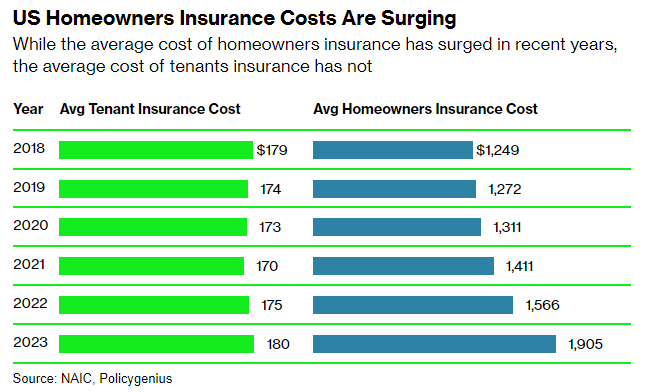

I guess the good news is that homeowners insurance is not directly calculated into the CPI index...

If the rising price of homeowners insurance were factored into the US Consumer Price Index — a key metric of inflation — it could have added 80 basis points, or about 0.8%, to last year’s CPI increase of 3.4%, according to an analysis from Bloomberg Intelligence.

By not including home insurance, the CPI “ignores climate costs,” writes BI senior analyst Andrew Stevenson in his April 9 note.

Homeowners insurance costs in the US hit roughly $175 billion in 2023, up 21% over the previous year, according to insurance brokerage Policygenius. The increase is in large part due to climate change, which is driving more extreme fires, floods and storms. The US endured a record 28 weather and climate disasters that caused at least $1 billion in damage last year. As insurers incur higher costs, homeowners are facing higher premiums. Inflation itself is also making it more expensive to pay out claims.

The average cost of insuring a US home last year was $1,905 — 50% higher than the average of $1,272 in 2019, according to the National Association of Insurance Commissioners and Policygenius.

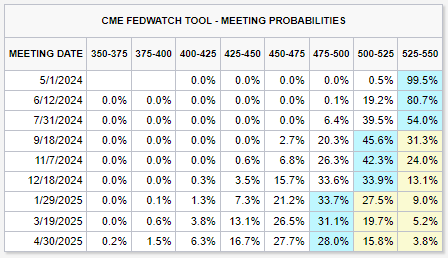

This Fed Funds rate chart looks nothing like it did two weeks ago...

Now we are down to the market forecasting one or two rate cuts in 2024.

And the 10-year Treasury has responded with a new 4.6% level...

Now on to earnings, Wells Fargo had a very positive read on the current economic activity as it touches their business...

“We continue to see strength in the U.S. economy. Spending patterns of consumers using our debit and credit cards remain generally consistent and continue to grow year-over-year. Consumer credit is performing as we expect, wholesale credit continues to perform well, and our views around commercial real estate have not significantly changed since last quarter. These are all positives.” - Wells Fargo CEO Charles Scharf

Fastenal had important comments about the weakness in their small customers versus strength in their large customers...

Fastenal Co., a distributor of factory floor odds and ends, unofficially kicked off the first-quarter industrial earnings season on Thursday with weaker-than-expected results. Sales of fasteners, the company’s namesake product line, fell 4.4% relative to the period a year earlier, the third straight quarter of declines and the worst performance since 2020 during the height of the pandemic shock to the industrial economy. Fasteners are most commonly used to manufacture new equipment, making them an important proxy for underlying industrial production trends.

“The core issue remains sluggish demand,” Fastenal Chief Executive Officer Dan Florness said on the company’s earnings call. Overall daily sales at Fastenal increased just 1.9% in the first quarter, roughly half the pace the company was expecting heading into the period, he said. Fastenal’s smaller customers in particular are bearing the brunt of the effects of higher interest rates and inflation. Sales to local, regional and government customers fell 4.5% in the first quarter, while revenue linked to larger, national accounts rose 6.3%.

CarMax also had many external factors affecting their quarter...

@bluff_capital: $KMX CarMax misses. "We believe vehicle affordability challenges continued to impact our fourth quarter unit sales performance, with ongoing headwinds due to widespread inflationary pressures, higher interest rates, tightened lending standards and low consumer confidence."/p>

Over at Constellation Brands, the beer business is doing very well versus their non-beer business...

@wallstengine: $STZ | Constellation Brands Q4 Earnings Highlights:

EPS: $2.26 (Est. $2.21)

Revenue: $2.3B (Est. $2.1B)

Beer Business Net Sales Growth: Nearly 11%

Beer Business Oper. Margin: Increased 30bps to 34.4%

Wine and Spirits Sales: Down 6%

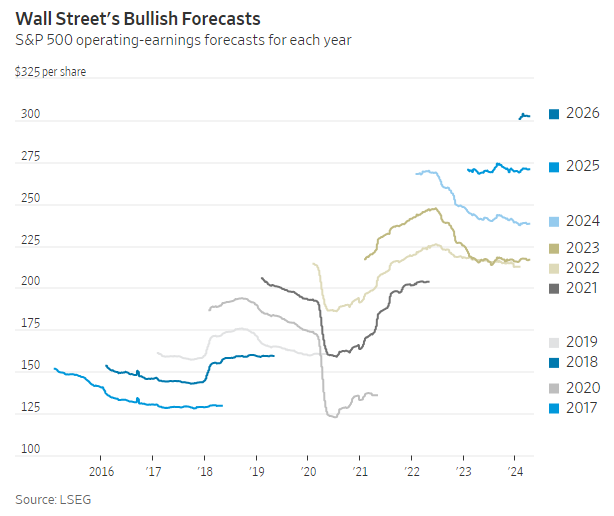

The market is keeping a close eye on the earnings forecasts which will likely dictate the direction of stock prices in the next month...

A lot rests on companies predicting that earnings will be even better in future quarters, because the market as a whole is priced for unusually fast growth. The S&P 500 trades at a multiple of 21 times predicted earnings 12 months ahead, a level exceeded only during the dot-com bubble and the pandemic rebound.

The good news is that a stronger-than-expected economy should be good for profits. The bad news is that a stronger-than-expected economy means fewer rate cuts this year, and perhaps none, which hurts the valuation of future profits.

This showed up on Wednesday, when inflation again came in ahead of predictions, bond yields jumped and stocks fell sharply. Futures markets are now priced for a 12.5% chance of no rate cut this year, by far the highest yet, according to the CME FedWatch Tool.

Wednesday aside, investors overall are still betting that higher profits will more than offset the hit from rates being above where they previously thought.

A bigger week of earnings again overweight with financial companies...

@eWhispers: #earnings for the week of April 15, 2024

Also in individual company news, it was a big week of M&A transactions...

- Encore Wire (WIRE -$4b mkt cap - R2000/SP600 holding) Prysmian (PRY.IT) has proposed to acquire Encore Wire for $290.00 per share in cash for a total enterprise value of approximately €3.9 billion, representing a multiple of 8.2x EV/2023A EBITDA and 6.3x EV/2023A EBITDA, including run-rate synergies

- Blackbaud (BLKB - $4b mkt cap - R2000 holding) Clearlake Capital offered a non-binding proposal to acquire all its outstanding shares for $80 per share.

- Snap One (SNPO - $600m mkt cap - R2000 holding) Resideo (REZI) has agreed to buy Snap One Holdings for about $821 million; Resideo said the transaction, which it expects to complete in the second half of the year is worth about $1.4 billion including debt.

- Medical Properties Trust (MPW - $2.4b mkt cap R2000/SP600 holding) said it received $1.1B of cash proceeds from the sale of a majority interest in five Utah hospitals through a newly formed JV ($886M) and secured debt placed in conjunction with the transaction ($190M).

- French lender BPCE will acquire Société Générale’s professional equipment financing business for $1.2B

- Brookfield Asset Management is in advanced talks to buy a majority stake in private credit manager Castlelake for over $1.5B

- Salesforce (CRM) is in advanced talks to acquire data-management software provider Informatica (INFA - $11.3b mkt cap - R1000 holding)

- Reportedly ADNOC took a look at BP Plc (BP - $111b mkt cap) as a potential takeover target, but decided that it was not a good fit after preliminary talks

- Vertex (VRTX) enters into agreement to acquire Alpine Immune Sciences (ALPN - $4.2b mkt cap - R2000 holding) for $65/shr in cash, valuing it at $4.9B

- Lok'n'Store (LOK.UK) offered to be acquired by Shurgard Self Storage (SHUR.BR) at £11.10/shr in £378M deal

This private market hotel deal looks to be among the best of the bunch with a 20x return over 17 years...

The majority owner of Motel One Group has taken full control of the budget hotel chain in a transaction that values it at €4.1bn, the latest sign of a return to dealmaking in the hospitality sector following the end of the pandemic.

Proprium Capital Partners, a real estate private equity group, has sold back its 35 per cent stake in Motel One to the company’s majority shareholder, One Hotels & Resorts, according to a statement on Tuesday.

Proprium is selling its stake for €1.25bn, having acquired it for €65mn in 2007, providing the company with a more than 20-times return on invested equity when dividends are taken into account. The deal values Motel One at €4.1bn including debt, said Proprium.

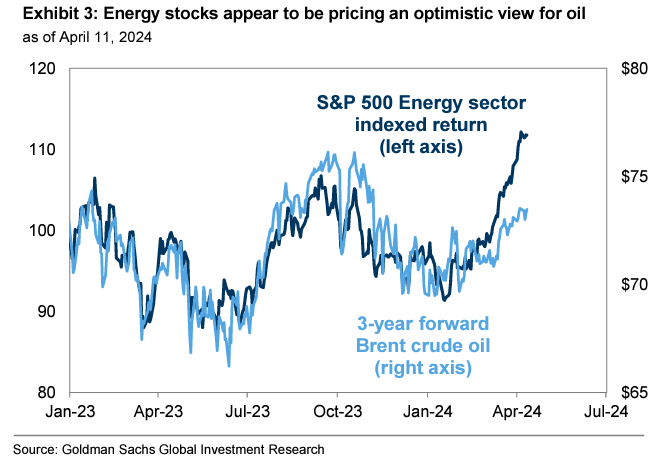

Hmmm, energy stocks are beginning to outrun the improvement in crude oil prices...

Goldman Sachs

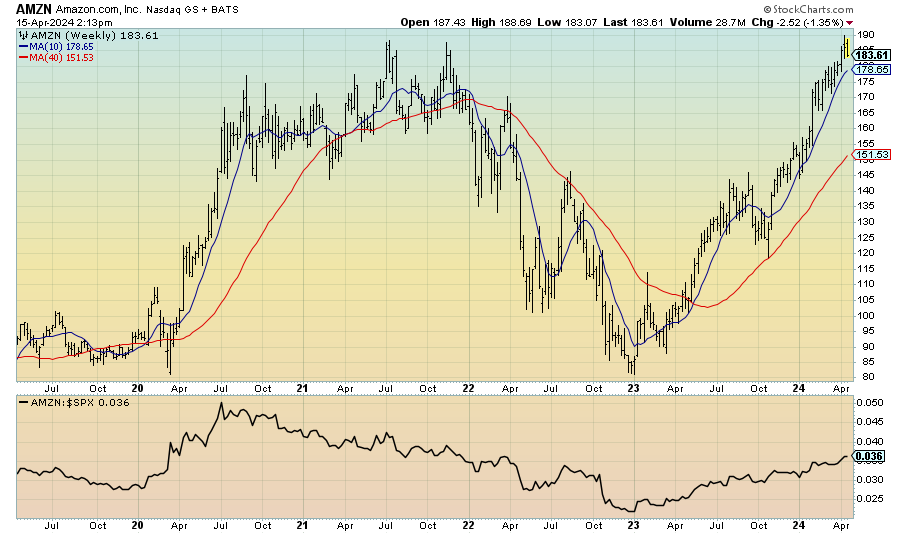

Lost in the news last week was $1.9T market cap Amazon hitting a new all-time high...

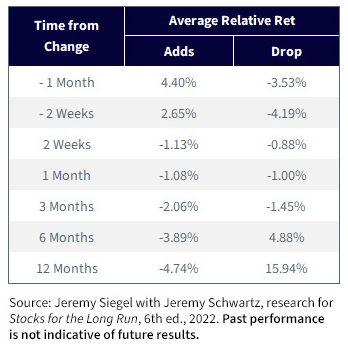

Buy high, sell low?

The growth of passive asset investing looks to be impacting the performance of additions and deletions into the S&P 500 index.

To get a better sense of this effect, we collected all the changes that occurred in the S&P 500 since 2019. This accounts for five years of constituent changes, specifically only looking at stocks that underwent changes where companies were chosen by the committee.

Adds: Specifically, stocks poised for inclusion in the S&P 500 tended to outshine the broader index by about 2.6% in the two-week run-up to their addition. However, once officially added, these stocks often fell short of the index and on average they underperformed by 4.7% over the next 12 months.

Drops: Conversely, companies on the verge of removal experienced an initial downturn, selling off before their actual exclusion. Yet, once removed, these stocks frequently started to recover, outpacing the index by nearly 5% on average in the following six months and by almost 16% over the next 12 months.

This pattern we see around the rebalance of indexes underscores how the explosion of passive investing and index changes can have long lasting impacts for adds/drops to the index.

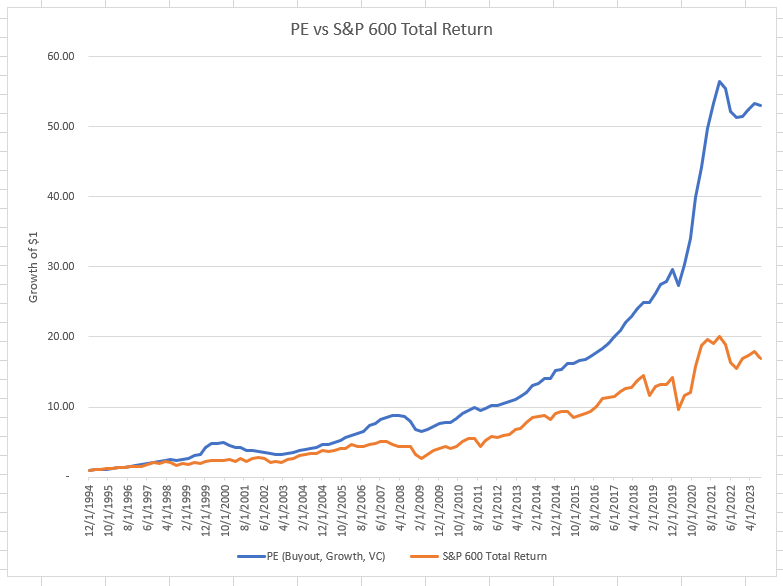

Another look at historical Private versus Public return data...

I was asked this week to compare historical Private Equity fund returns against ONLY publicly traded profitable small cap companies. Fearing days of number crunching and electricity usage, I did remember that the S&P 600 small cap index does have a profitability requirement at the point of inclusion. Now this doesn't mean that all companies must remain profitable to remain in the index, but it does explain why only 15% of the market cap weight of the S&P 600 is made up of money losing companies, as compared to nearly 30% in the Russell 2000.

Using the S&P 600 as a proxy for more profitable small cap companies, I compared the total return of that index versus Cobalt's returns for Private Equity funds. Here I grabbed the time weighted return data for the Buyout, Growth Equity and Venture Capital fund categories over 30 years. As you can see below, even with a focus on small company profitability, PE still outperformed by a large margin. And if you want to know how the larger set of Russell 2000 companies did over the 30 years, they only rose about 10.5x versus the S&P 600 at 17x.

Source: 12/31/1994 - 9/30/2023 quarterly data from YCharts & Cobalt

Australia's largest pension plan sees the advantages of Private Equity investing and is looking to double their allocation...

AustralianSuper, the country’s largest pension fund, plans to almost double its private equity assets over the next four years as deals pick up following a lull spurred by higher borrowing costs.

The fund, which oversees A$330 billion ($215 billion) of assets, is seeking to boost its private equity allocation to as much as 9% of its portfolio from 5% currently, Chief Investment Officer Mark Delaney said in an interview. That will eventually lift total volumes to around A$35 billion, he said.

The goal compares with a previously announced 7% target two years ago that AustralianSuper hoped to achieve by 2024. The shortfall in reaching that underscores the pressure facing institutional investors in securing attractive deals as higher interest rates weighed on transactions.

Now, Delaney expects activity to increase, while valuations will also begin to climb after a shallow pullback. “We’ve seen the lows in private equity prices,” he said. “Prices haven’t gotten as cheap as in previous downturns.”

We are going to need more energy...

"It's going to be difficult to accelerate the breakthroughs that we need if the power requirements for these large data centers for people to do research on keeps going up and up and up. By the end of the decade, AI data centers could consume as much as 20% to 25% of US power requirements, Today, that's probably 4% or less." - Arm CEO Rene Haas

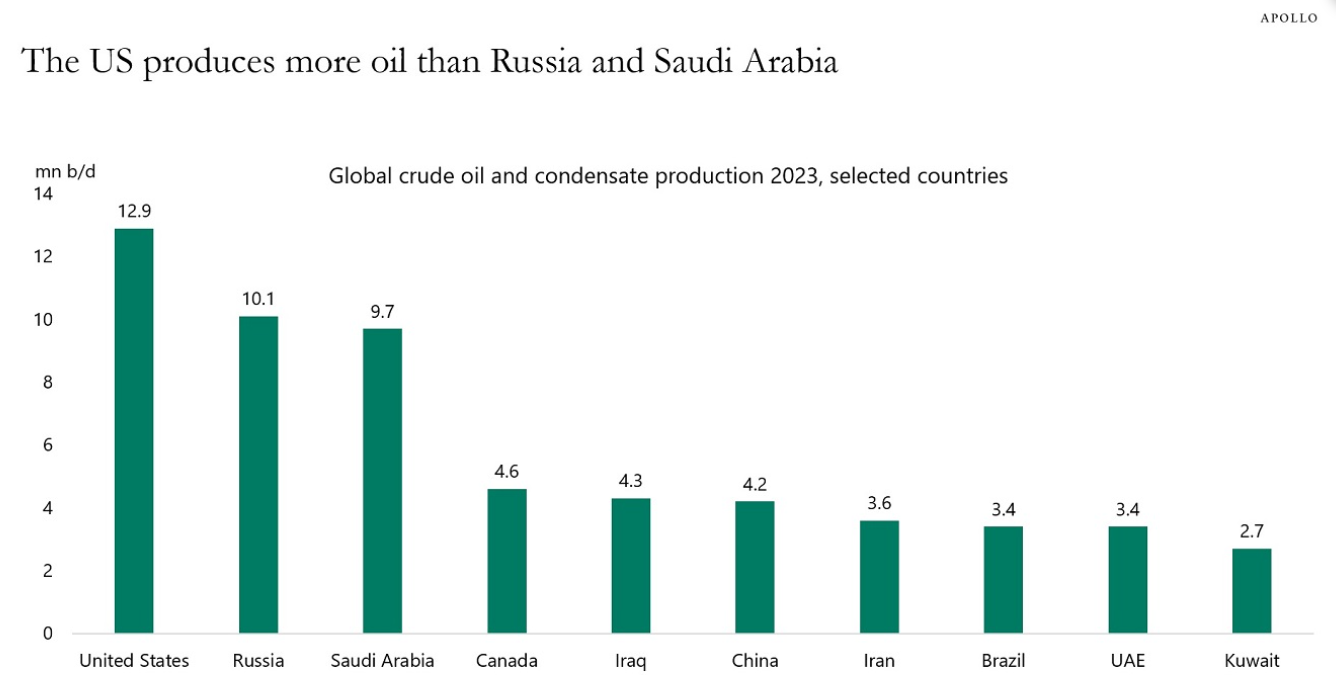

It is a good thing that the U.S. has now become the leader in producing energy molecules...

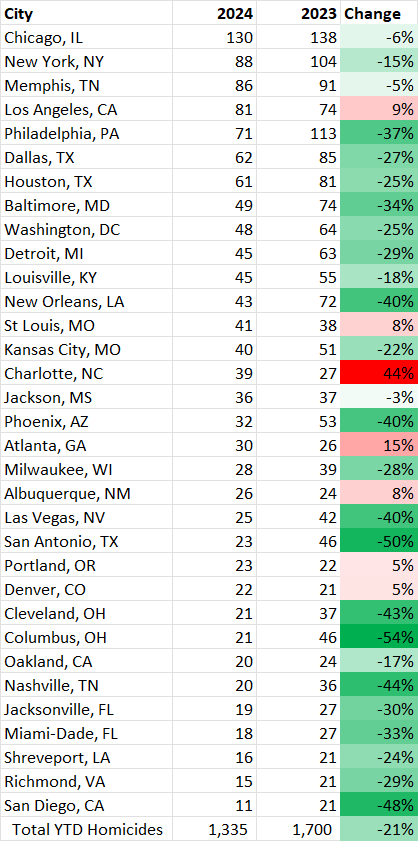

U.S. homicide rate on pace for the lowest level in 60 years...

I saw the chart on the front page of the Wall Street Journal Monday showing the sharp decline in homicides nationwide and had to crack open the source analytics website. From there I grabbed all the data of cities with over 20 homicides a year ago and then compared this years numbers. The table is below and does confirm the spectacular decline from last year. It is too bad that these positive results are not more widely reported.

Homicides in American cities are falling at the fastest pace in decades, bringing them close to levels they were at before a pandemic-era jump.

Nationwide, homicides dropped around 20% in 133 cities from the beginning of the year through the end of March compared with the same period in 2023, according to crime-data analyst Jeff Asher, who tabulated statistics from police departments across the country...

If the trend continues, the U.S. could be on pace for a year like 2014, which saw the lowest homicide rate since the 1960s. But police officials and researchers cautioned that crime trends aren’t always consistent and future homicide rates are difficult to predict.

I found a third health/nutrition book that has further influenced my daily routines...

My new book is the N.Y. Times bestseller Outlive: The Science and Art of Longevity by Peter Attia & Bill Gifford. And once again, I wish that I could have read this book in my 20's but that is all in the past. Now let's see if I can get this body into the healthy triple digits.

And before anyone asks, here are the other two books that I have written about in the past that have made my life better:

Why We Sleep: Unlocking the Power of Sleep and Dreams by Matthew Walker

The Third Plate: Field Notes on the Future of Food by Dan Barber

Speaking of running through 100, here is a great interview with the legendary and 91 years young Ed Thorp...

The mathematics professor and hedge fund manager Edward Thorp rocketed to fame in the early 1960s by showing readers how to best casinos in blackjack. His book Beat the Dealer laid out a groundbreaking system of card counting, followed by guides to roulette and other gambling games. Thorp also invented or perfected a number of the quantitative hedge fund strategies being used today, and he delivered 30 years of 20% annual returns for the hedge funds he operated, with only a handful of down months, none large.

Less well known is that Thorp has devoted his talents as much to health and longevity as to beating casinos and markets. At 91 he’s remarkably healthy and vigorous. Although he’s no longer running marathons or doing serious weight training, Thorp jogs and works out at the gym regularly. He weighs 155—2 pounds above his weight at age 17—and can do two chin-ups and 15 pushups. He analyzes scientific literature and manages his regimen carefully.

We sat down with Thorp to distill his wisdom on the subject.

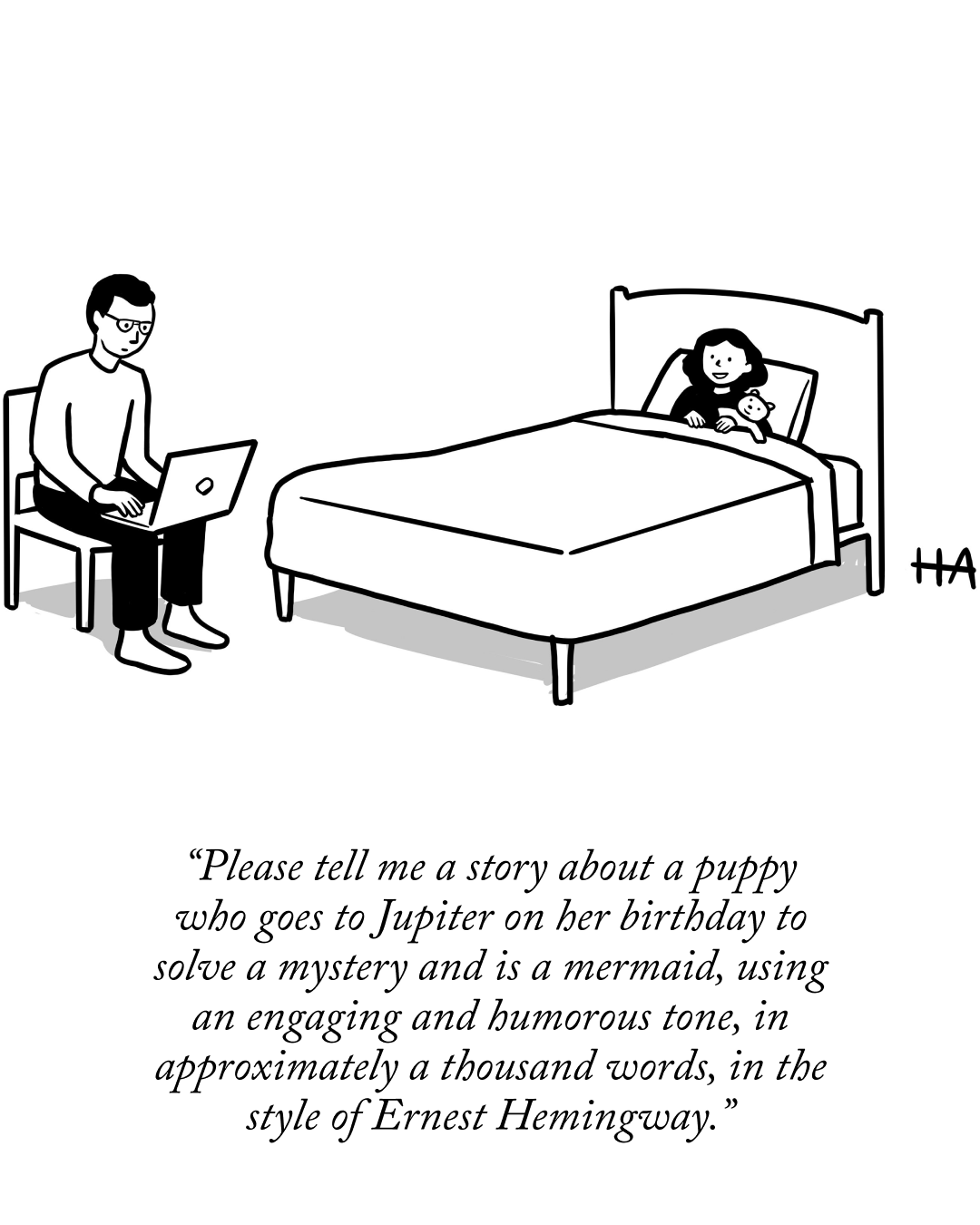

And finally, parents have it so easy these days...

@NewYorker: A cartoon by Hilary Allison. #NewYorkerCartoons http://nyer.cm/A86Cb8v

Learn more about the Hamilton Lane Strategies

DISCLOSURES

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Hamilton Lane is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Hamilton Lane.