Weekly Research Briefing: Between Phases

For many of you with kids in school, this week or next is spring break. And as is customary, many of you will be traveling to an ocean or to a mountain to enjoy water in either its liquid or solid form. Some of you might be doing both if a trip to Scandinavia or the Pacific Northwest is part of your plan. It is great to have the option to choose water, snow or ice sports this time of year.

The financial markets are also enjoying a multi-phase period of time where investors' appetite for assets is large, and companies are increasingly open to fixing balance sheets and transacting operational assets. If water's perfect state is at 50 degrees Celsius, then it sure feels like where our current financial markets are headed. You can see companies refinancing debt at improved spreads and making plans to go public. Public companies are using their stock as currency to make acquisitions or even show up to an M&A announcement with full financial backing from banks or private equity.

I saw the Bain Global report on Private Equity last week. These headline items attracted much interest:

- “With exit channels in deep freeze, unsold assets are piling up in private equity portfolios, preventing distributions to investors and threatening future fund-raising.”

- “With buyout funds sitting on 28,000 unsold companies worth a record $3.2 trillion, the current threat to investor cash flows is very real.”

I will agree that in the rear-view mirror private equity distributions have been significantly decreased due to reduced M&A, reduced IPO activity and the post-SVB banking freeze. But when I look across the markets today, I see nothing like the fall of 2022 or March 2023. If anything, I see the opposite. A healthy economy, falling inflation, very tight credit spreads, rising corporate earnings and healthy public stock multiples. I don't think that anyone believes that private equity fund distributions will remain low for long. I'll unpack this further below.

No spring break for Central Bankers this week as the Federal Reserve is joined by 13 other central banks around the world to make rate decisions. You can expect a hold on rates for the FOMC on Wednesday. All forecaster eyes will be tuned into the direction of the dots to give us a hint of how fast the Fed members think inflation could be falling. A very light week for economic data, but we will get some key housing reads to look through as the spring selling season begins. Travel safe and enjoy your break.

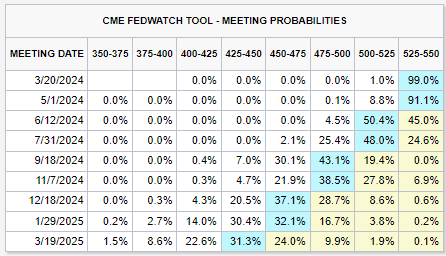

The bond markets has moved to forecast three rate cuts with one each in summer, fall and the winter holidays...

Last week's inflation data again came in hot as shelter and services remain sticky. Will the stronger than expected economic growth erase hopes of raining dots at this week's FOMC meeting? Stay tuned.

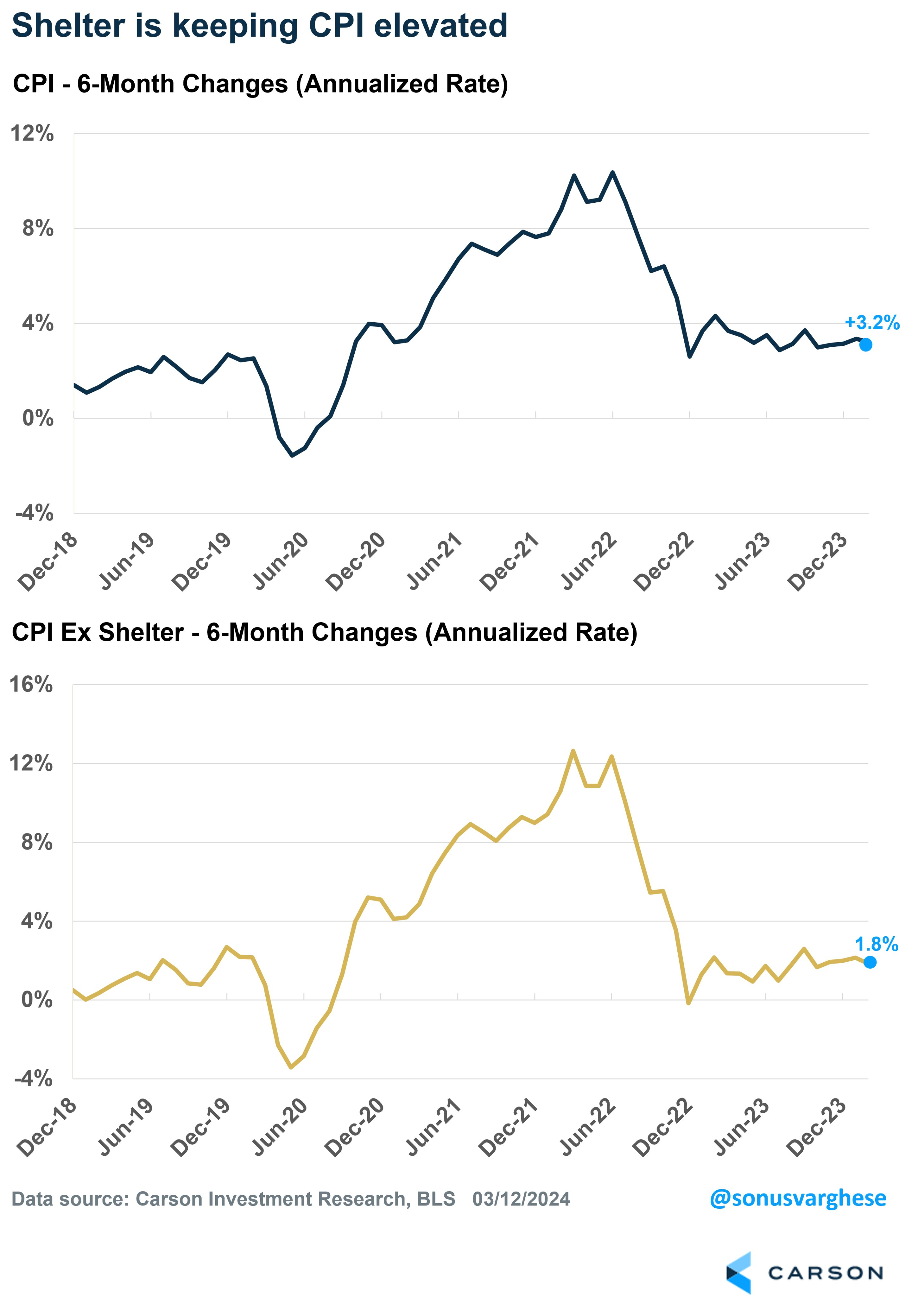

Shelter remains a thorn in the side of the CPI data...

@RyanDetrick: CPI up 3.2% annualized the past 6 months. Take out shelter, it dips to 1.8%. Yes, shelter matters, but when 60% of people own a house and many are locked in at rates sub 3.5%, how much does it matter?

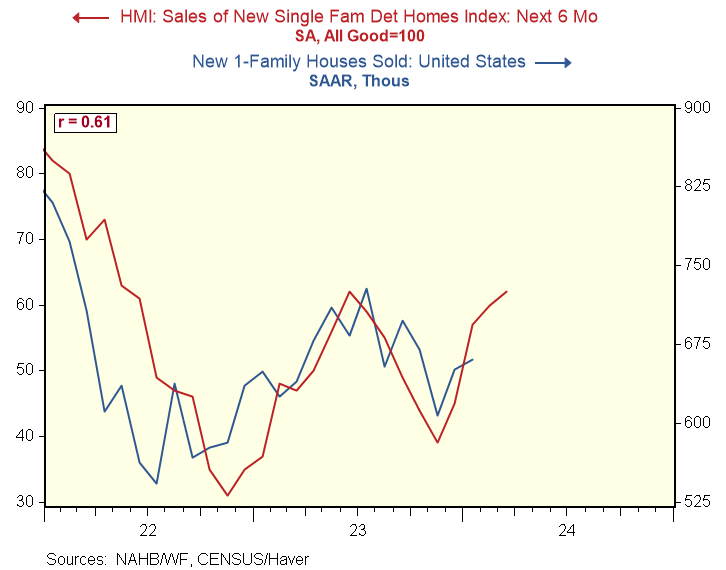

Speaking of shelter, the March NAHB index surprised to the upside indicating higher mortgage rates should not slow 2024 housing demand...

@RenMacLLC: Builder confidence improved in March. The six-month outlook improved to 62, the highest level since June 2023. This implies that new home sales strengthen over the coming months, a positive sign for residential investment.

"Louis: Looking Good Billy Ray! Billy Ray: Feeling good Louis!"...

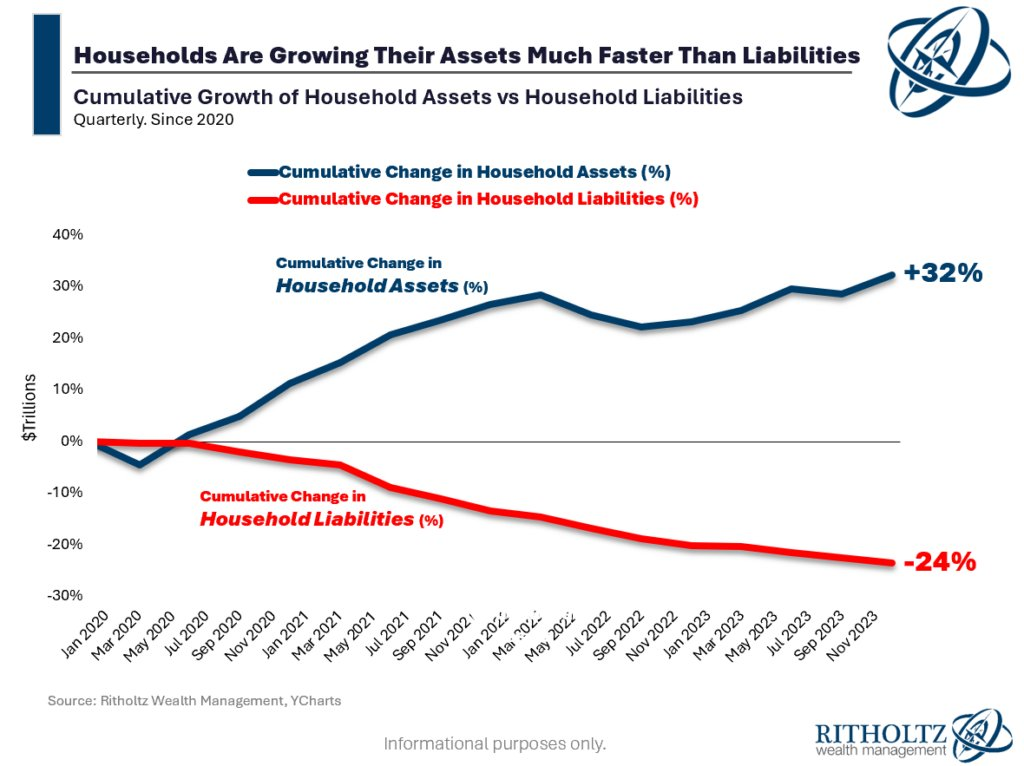

With 40% of U.S. homeowners no longer having a mortgage and housing and stock prices surging, household net worth is in fine shape. Good luck trying to find a non-politicized survey showing how well households are feeling about this data.

@awealthofcs

"The sheer magnitude of the wealth creation has been staggering"...

“When I started compiling the numbers, I haven't done this in a couple of years recently, I found it staggering that almost $100 trillion of household wealth has been created in the last 12 years or so. To put that in perspective, it's about 400% of nominal GDP. I don't have a chart here, but take my word for it that not only the sheer magnitude of the wealth creation has been staggering the pace at which we are creating wealth, which typically tends to be about 25% to 30% of GDP every year is running about 50% higher than that. And that has been an important reason why the U.S. economy is actually performing really, really strongly even in a rate environment that would be deemed and we agree with that assumption to be quite restricted” - PNC Financial Services CIO Gagan Singh

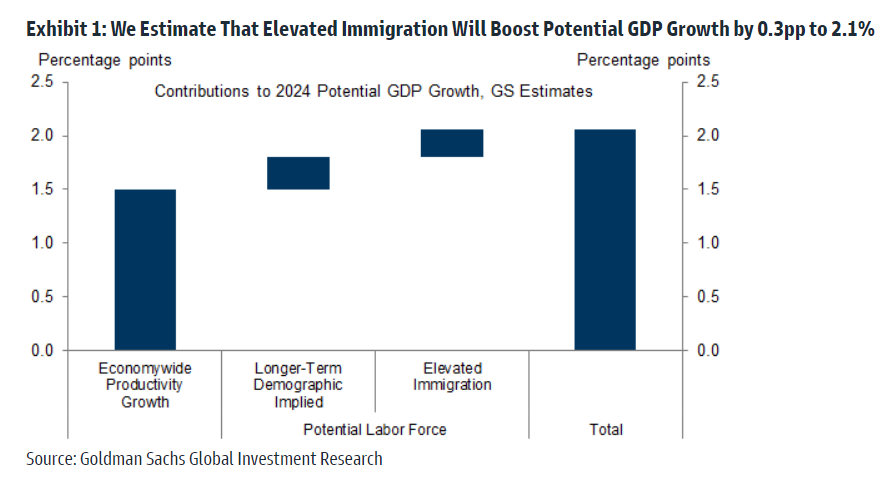

New Census data analysis has shown that higher than forecast immigration has boosted job growth and with it U.S. Gross Domestic Product...

Continuing the trend is leading many economists to raise their 2024 GDP outlook. Here are Goldman's adjustment. Good work Topeka, Kansas.

Recent studies suggest that Census data used for the household survey of the employment report understated immigration in 2023. We estimate that immigration was 1½mn above the trend of roughly 1mn per year in 2023, which implies an 80k boost to the monthly breakeven rate of job growth to 155k. We expect immigration to be about 1mn higher than usual this year, implying breakeven job growth of around 125k and a 0.3pp boost to potential GDP growth in 2024 from faster labor force growth.

Goldman Sachs

Another big Wall Street strategist pushes their 2025 S&P 500 estimate to $275...

Higher GDP plus stronger Q4 corporate earnings results combined with a better margin outlook for 2024 is leading to increased S&P 500 estimates.

BofA Global

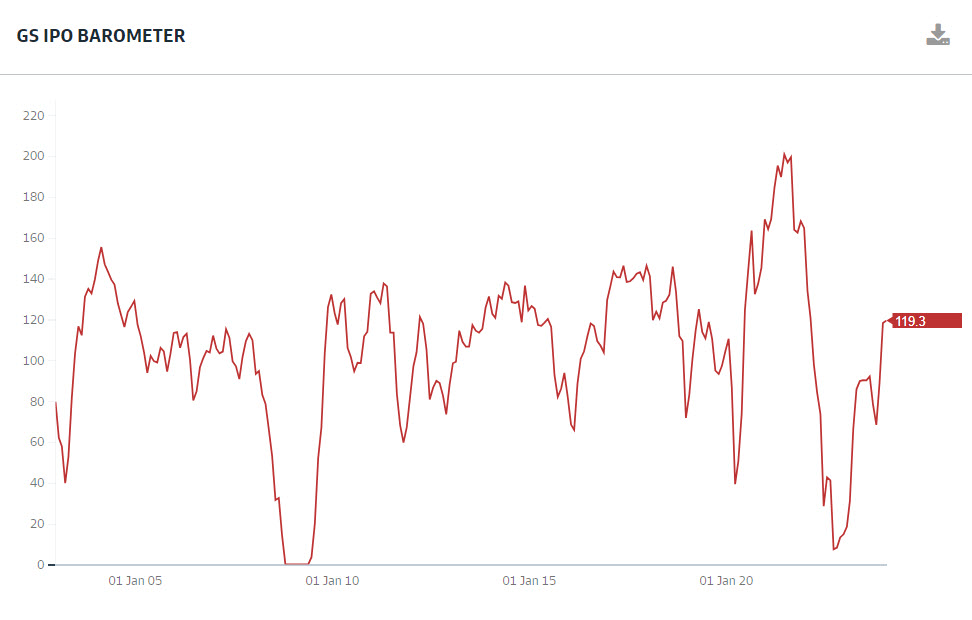

Unpacking the previously mentioned Bain Global PE report...

Let’s first check on the current status of the ‘private equity exit channel deep freeze’. Here is the Goldman Sachs IPO Barometer. This is a makeup of the S&P 500 drawdown, CEO confidence, rate of change in the 2-year U.S. Treasury note yield, S&P 500 EV/Sales and the ISM Manufacturing. Few of these five components are seeing any current weakness and seem to be only strengthening. At the current level, it looks like most any company can raise money by going public. Now let's see how the Reddit, Douglas and Galderama IPOs do this month.

Goldman Sachs

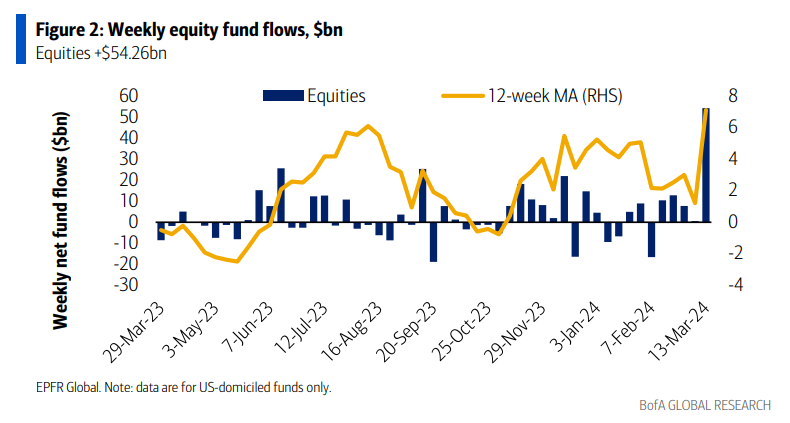

The current appetite for stocks by investors hit the highest in three years last week...

BofA Global

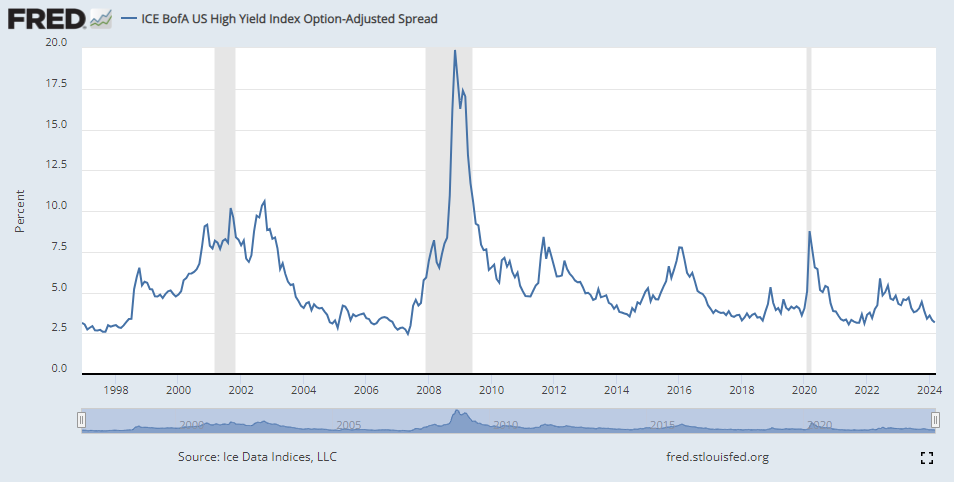

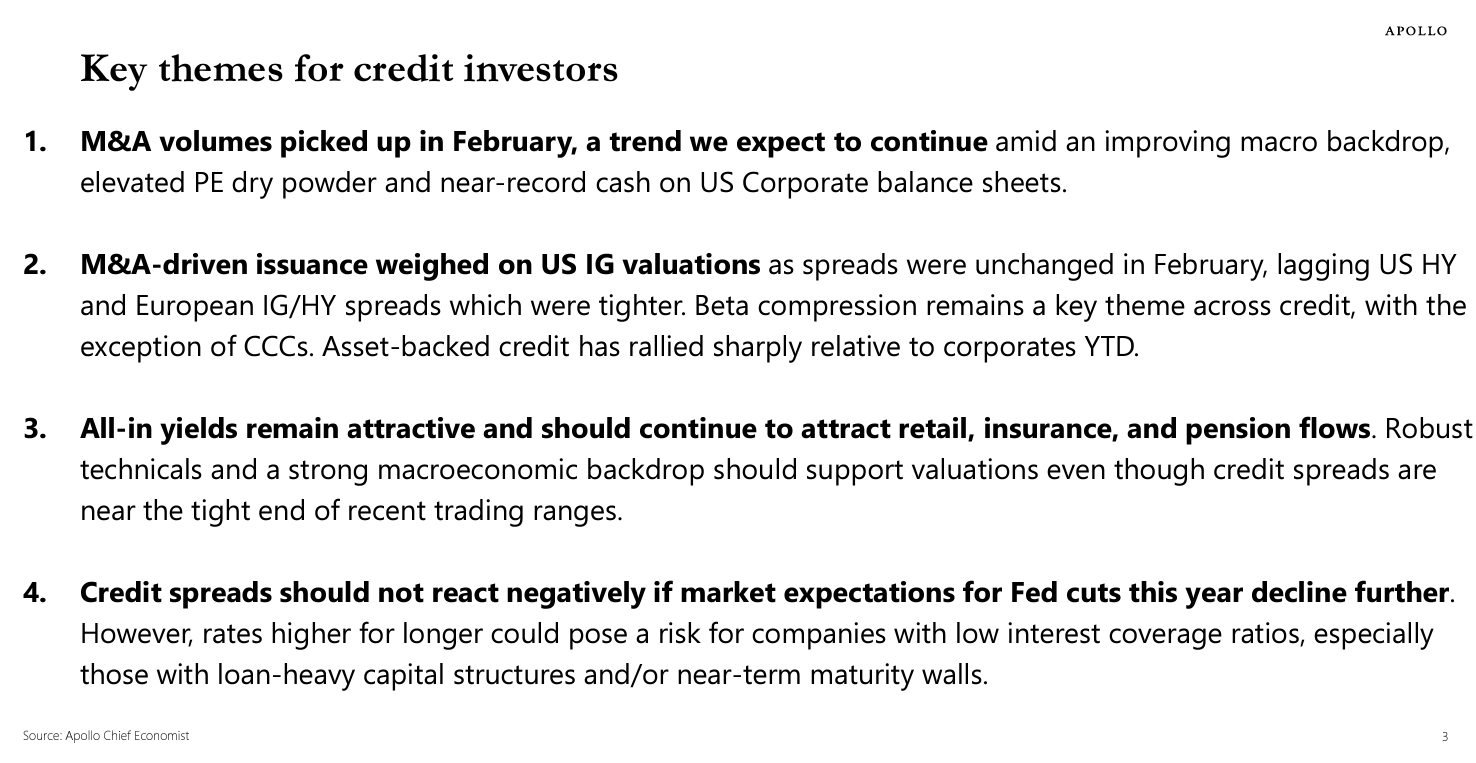

As for the credit markets, they are as open as Victor Wembanyama’s wingspan…

Silicon Valley Bank was a temporary mess, but we are so far past the year ago events. Now banks are running back to compete in the corporate credit markets. Any halfway decent company can find an open checkbook to refinance their debt with spread talk being offered at ridiculously tight levels. So even if a company sitting in a GPs fund is unable to find a buyer or go public, it can find financing to sit tight on the bench until it is time to play ball.

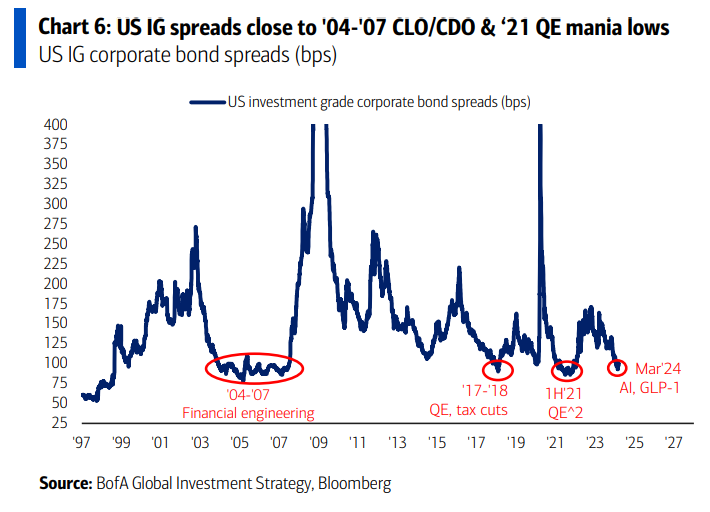

High yield debt spreads are eyeing pre-GFC levels...

Even high grade debt spreads are at 20-year lows...

BofA Global

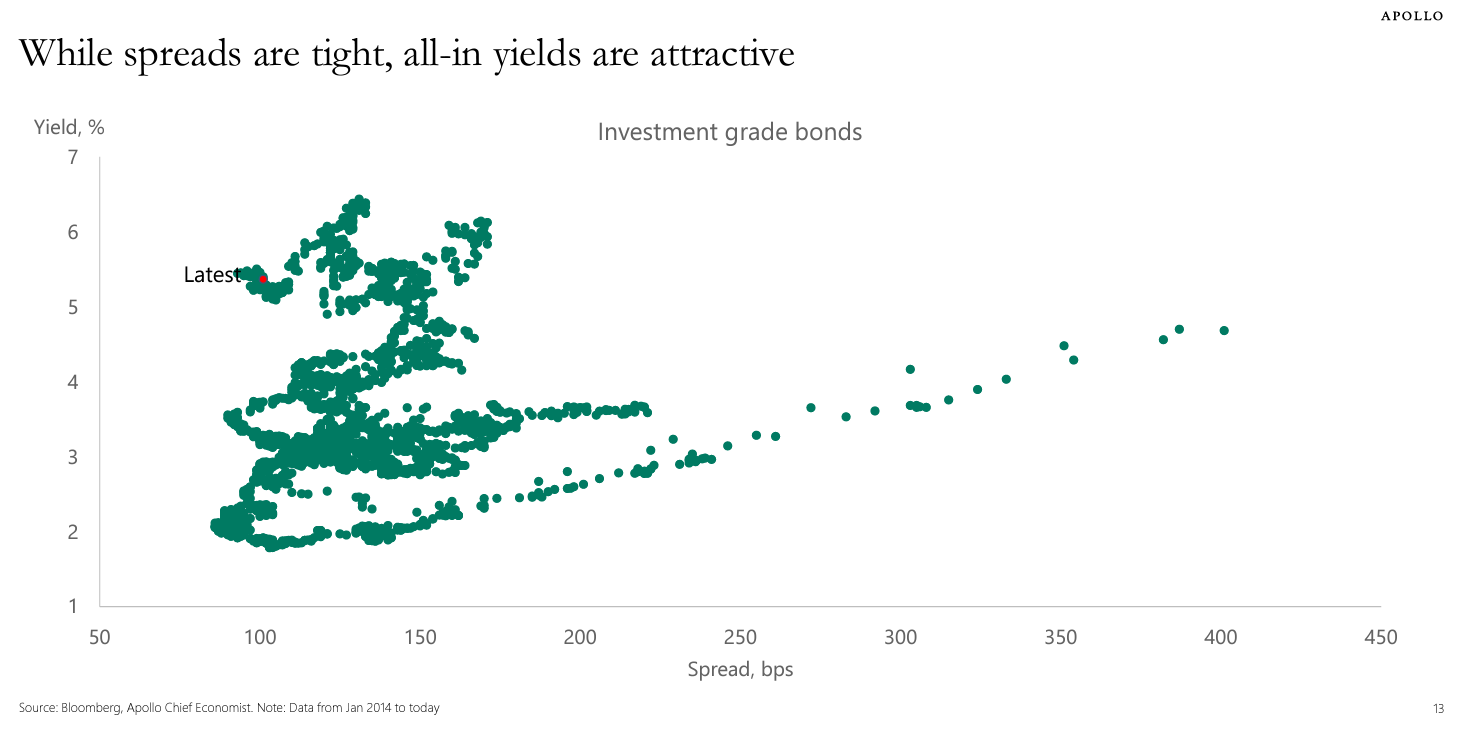

Central bank hikes of the last two years have pushed total bond yields to levels attractive to investors...

Yields at these levels will continue to keep the buyers interested and the debt financing markets very liquid for corporate borrowers.

Torsten Slok at Apollo Global has further thoughts on the credit markets...

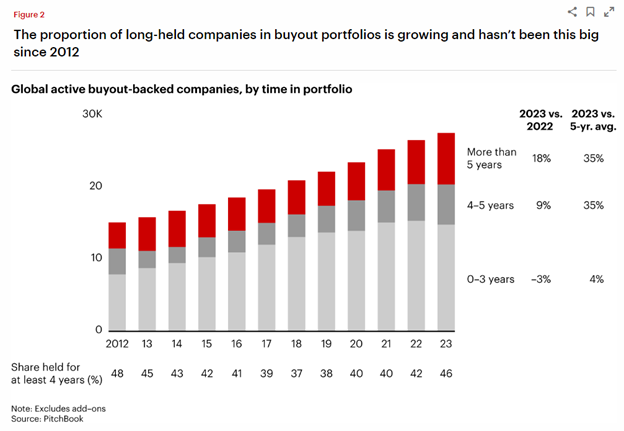

Now let’s look at the 28,000 unsold companies worth $3.2T sitting in global buyout funds…

In looking at the chart below, the total number of companies held by GPs continues to grow in a linear fashion. The change this time is that the average age of companies is getting older. While some might believe it is due to more problem assets, we know that there are many other reasons besides a bad investment. The CEO of JPMorgan, Jamie Dimon, has told us multiple times that it is much more difficult to be a public company these days. The board of Spirit Airlines might add that public shareholders can be idiots given the recent hijacking of their merger with Frontier Airlines. COVID and the recent Federal Reserve rate increases also made all investors rethink and evaluate their investment and allocation strategies which led to some pauses across the markets. And look at the largest, most widely held private company, Stripe, who sees little need of going public now that it is profitable and can finance its own growth.

$3.2T in unsold companies is a drop in the bucket for a world that wants to invest and acquire good assets…

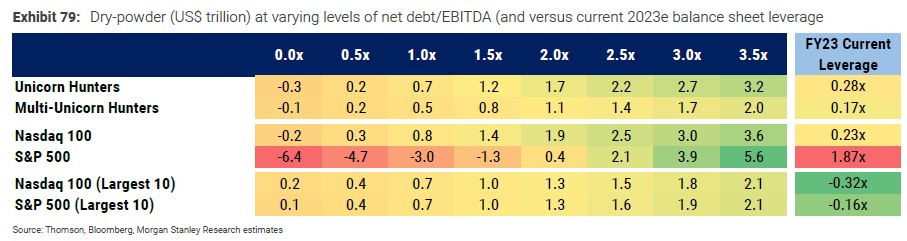

The current leverage in the S&P 500 is about 1.8x. If the CEO’s of the S&P 500 decided to go on an acquisition binge and needed to borrow, they could raise about $4T in dry powder by only increasing their leverage by one turn of debt/EBITDA. (See chart below.) Expand this move overseas and you could probably raise another $1T. Add in $0.5T from Berkshire Hathaway and the other non-financials in the S&P 500 and you are at about $5.5T. Now let’s include the $1-2T raised and sitting as dry powder in PE funds and you are near $7T in cash that could be tapped to buy companies sitting in all PE buyout funds. Even if only half of the $3.2T is transacted on in the next few years, this would be more than enough to get GP and LP’s liquidity flowing. In other words, don’t worry about good companies being able to find future buyers.

Morgan Stanley

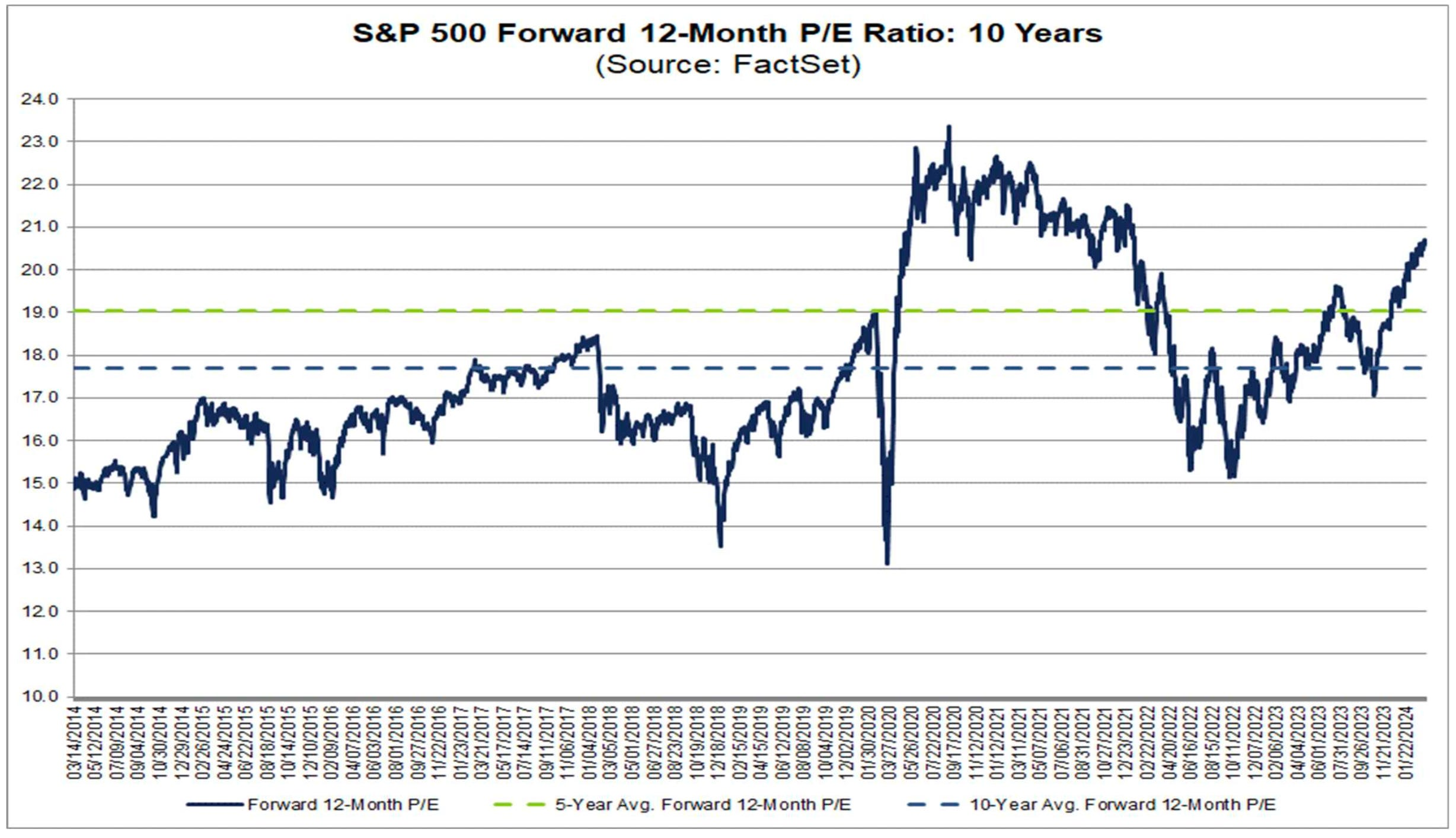

Looking at current forward market valuations shows that we are near 10 year highs...

Good both for comparative valuations as well as for public companies looking to use their multiple to issue stock to finance a M&A transaction.

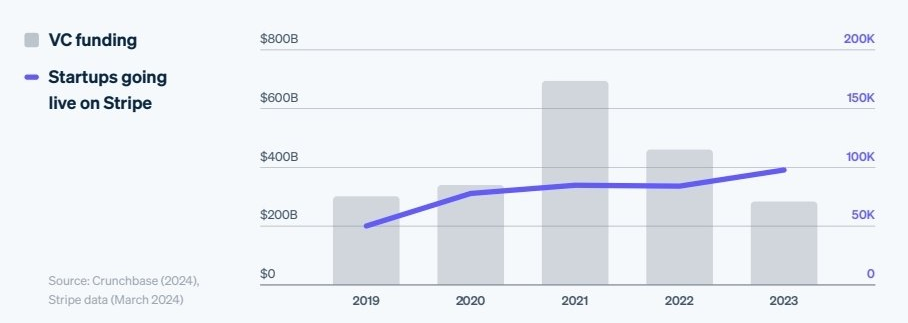

Finally, every investor (public and private) should spend time with this week’s Stripe Annual Report…

In it, Stripe discusses not only its own business and future opportunities, but also the state of the world for all private and public companies. Patrick and John discuss not only how they have become a profitable company but also how the current entrepreneurial environment is much more active than the private funding market suggests. Stripe is the largest, widely held private company in the world. Now that they are profitable, they do not need anyone’s capital. With the private capital markets able to easily and quickly generate capital for employee needs, Stripe may never go public.

“Although VC funding in 2023 hit its lowest levels since 2018, we’ve actually seen record startup formation across Stripe. Perhaps as a result of the tighter funding environment, entrepreneurs are focusing on monetizing faster and enabling profitable growth as soon as possible. Startups founded in 2022, the most recent year where we have a full year of analyzable data, are 60% more likely to start collecting revenue within their first year, and 57% more likely to process $1 million within their first year, than those founded in 2019.”

“In 2023, the influx of AI companies onto Stripe grew even larger. Twice as many AI companies went live on Stripe compared to 2022, including new trailblazers like Perplexity and Mistral. They join leaders like OpenAI, Anthropic, and Midjourney, which continue to expand their offerings and launch new products with Stripe. Aggregate revenue from AI companies grew by 249% in 2023, and, of course, AI was a major tailwind for countless companies across Stripe that do not self-identify as “AI companies” per se. While headlines inevitably index on the most legible figures, such as declining venture dollars, our net assessment is that the startup ecosystem is more vibrant than ever before.”

Make sure you also read the interview with Dr. Damodaran in the Financial Times last week...

If there is a full time professor who has helped investors make more money in the financial markets, then I do not know who he or she is. Go Bobcats!

If you look at all four dimensions — earnings, cash flows, the risk-free rate and the equity risk premium — the market has found a sweet spot. The problem is that no sweet spot lasts forever. So which of these four components is the weakest link? I would be concerned about earnings the most. I know we put off a recession last year, but you worry about a slow motion slowdown. When things slow down, you don’t even realise what’s happening under the surface.

Given where those numbers are, I think the market is fully priced, not cheap by any means. The risk premium I’m looking at — the returns you can make over and above the risk-free rate — is about 4 to 4.5 per cent, which is roughly where it’s been for the last 60 years. From that perspective, this story of “this is a bubble that’s going to burst” is kind of overwrought. That story seems to be based on a PE ratio that’s too high. I don’t know when people will realise that when metrics haven’t worked for 15 years, perhaps the problem is the metric, not the market!

Will there be a correction in markets? Of course. When you’ve gone up this much this quickly, there will be cleaning up. Are there segments where the market has over-reached? Absolutely. Anything with the word AI in it probably has too much buzz in it. There are segments you should probably stay away from for the moment, if you are jumping into the market. But if you have them already in your portfolio, I wouldn’t be selling them and running for the hills.

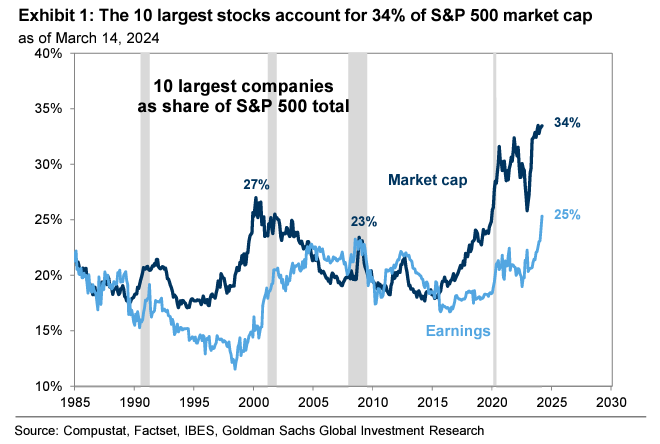

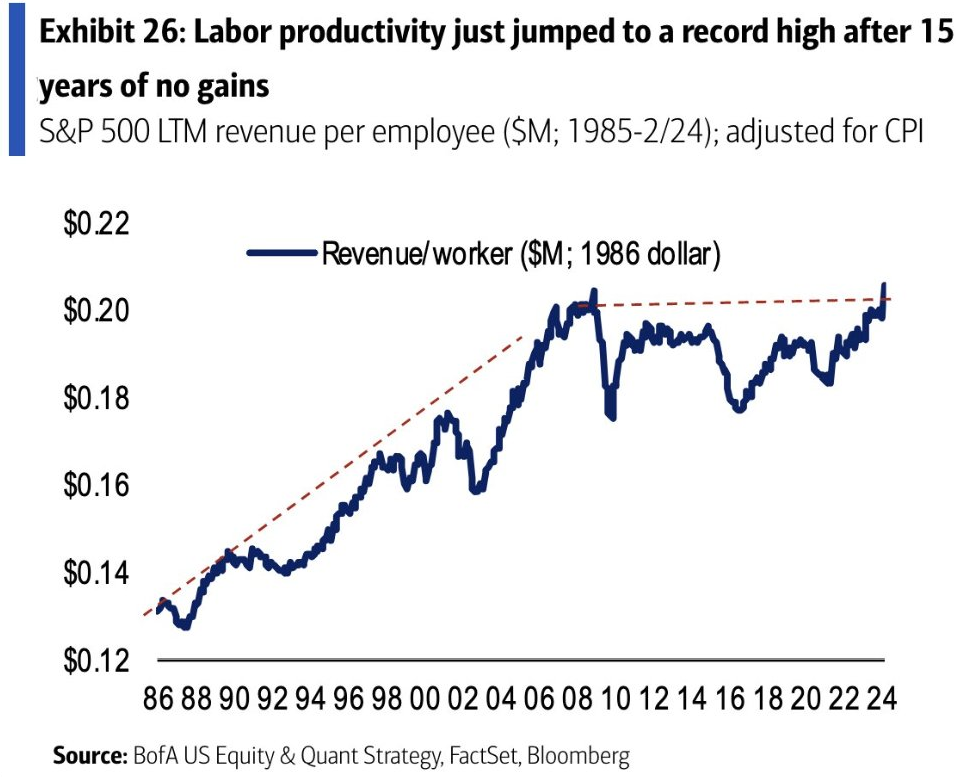

The top 10 stocks have most benefitted from AI. Now time for every other company to join in...

AI has first benefitted the software and hardware tech companies which is seeing a boost to sales and earnings. The next wave of beneficiaries will be those companies that can harness AI to improve their margins and earnings. Think of companies like The New York Times, CarMax, Walmart, Walgreens, Robert Half, Tenet Healthcare and many others as to how they might incorporate AI to increase their sales productivity and lower their cost structures.

Goldman Sachs

One specific cost savings example here from Procter & Gamble who will use an AI demand forecasting system to cut its fleet of delivery trucks by 30%...

TOKYO -- P&G Japan seeks to shrink its fleet of delivery trucks by 30%, adopting an AI system that predicts product demand to boost logistics efficiency.

The Japanese unit of U.S. consumer goods supplier Procter & Gamble will start using the system as early as late 2024, with the goal of covering around 70% of deliveries by 2025.

P&G Japan currently uses about 180,000 trucks a year and a 30% cut would slash about 54,000 trucks.

Japan is bracing for an acute driver shortage starting in April as new restrictions will cap overtime work for delivery drivers at 960 hours a year. In order to lessen the burden on drivers, the government is calling on retailers and wholesalers to ensure a sufficient timespan from order to delivery.

The demand forecasting system will be linked to retail and wholesale inventory management systems, allowing users to see information like store inventory, order status and sales promotion measures in real time.

The artificial intelligence will be trained on changes in sales due to seasonal factors and promotional measures to better predict product demand and estimate the number of trucks needed.

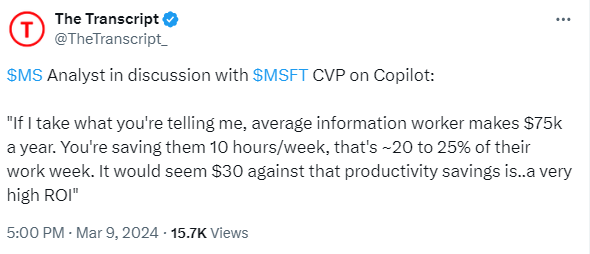

Or think of AI more broadly in helping all white collar workers...

It will be interesting to see where this chart runs to over the next few years as AI adds value...

BofA Global

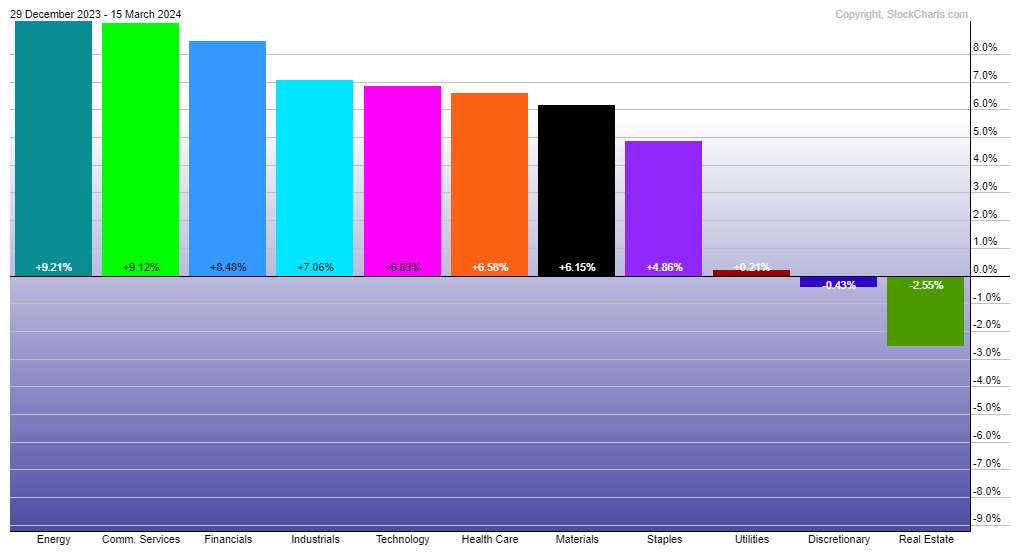

With all the focus on the top 10 stocks in the S&P 500, it might surprise you to see what the leading sectors in the market are for 2024...

AI is not even dominating the private markets. Try canned water...

Liquid Death closed a $67 million financing round valuing the beverage company at a $1.4 billion valuation. The money will be used to grow distribution nationally to meet demand and accelerate product innovation, the company said in an announcement...

Liquid Death said it had $263 million in retail sales through registers in 2023. The fast-growing water and tea manufacturer posted triple-digit growth for the third consecutive year, according to SPINS data cited by the company...

The $1.4 billion valuation is a “strong increase over prior funding rounds,” the Los Angeles company said. The last funding round for Liquid Death occurred in October 2022 when it raised $70 million, valuing the brand at $700 million...

Liquid Death, known for its tagline of “Murder your thirst,” reportedly hired Goldman Sachs last summer to help it with an IPO later this year.

Even cardboard cut outs are doing well in driving sales..

Talk about old school advertising! This story is great.

Placing cardboard cut-outs of doctors and nurses carrying health-promoting messages in a Manchester supermarket led to a 20 per cent rise in fresh sales, and a 30 per cent increase in frozen fruit sales.

The life-size cut-outs of real doctors and nurses who work in the Salford area were positioned within the fruit and vegetables section, while additional prompts included promotional materials bearing the message ‘Let’s Shop Healthier’ displayed inside and outside the store, and free ‘bags for life’ for shoppers to pick up at the fresh produce section when purchasing fruit or vegetables.

The images, according to Edwards, trigger a phenomenon known as ‘priming’ - the idea that individuals may become pre-disposed to make certain choices in one environment if influenced by triggers in a previous or linked environment.

He added: “If applied at supermarkets nationwide, this initiative could increase the average daily consumption of fruit, and as such improve the health of the two-thirds of the population who are not currently eating five portions of fruit and veg daily.”

Learn more about the Hamilton Lane Strategies

DISCLOSURES

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, Hamilton Lane is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of Hamilton Lane.