Acceleration of Trends: Sector Preference Shifts

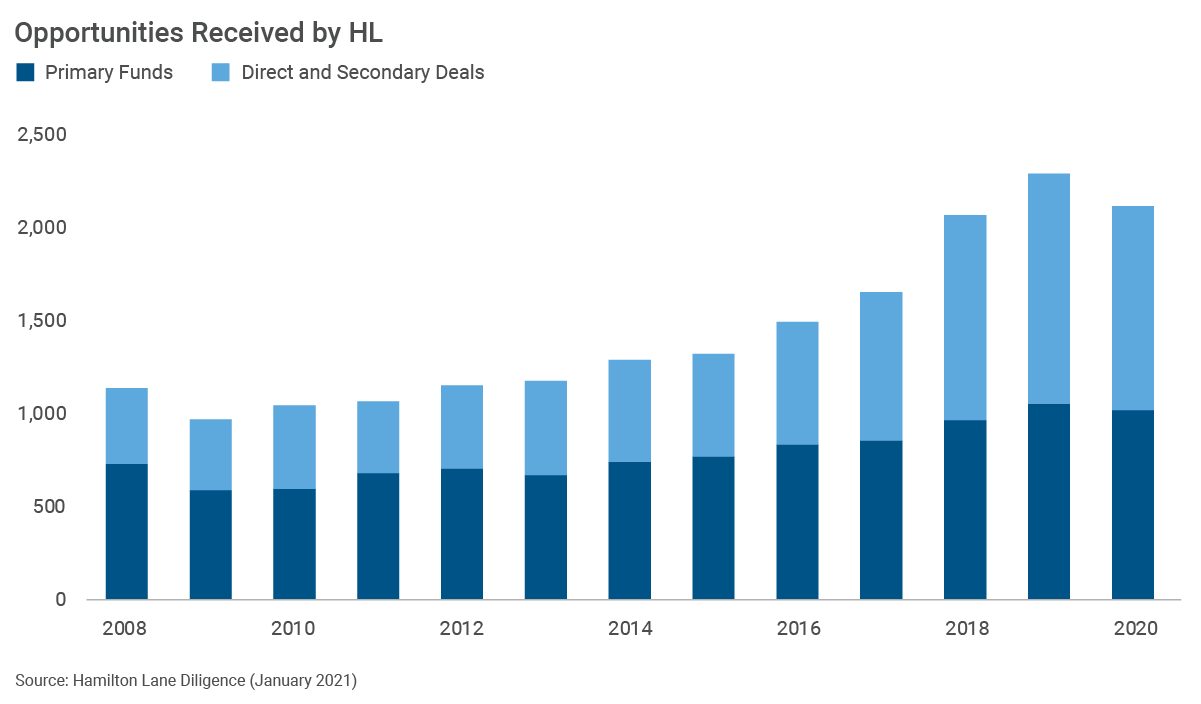

One of the key features of the private markets evolution since the early 2000s has been the increasing diversity and optionality available to investors. In 2020 alone, Hamilton Lane reviewed more than 1,000 new fund investment opportunities. There aren’t many areas in our everyday lives where we are faced with so many distinct options – even Baskin-Robbins’ 31 flavors doesn’t come close. In addition to traditional fund structures, LPs increasingly are investing in the asset class through transactions that aren’t captured in the fundraising statistics, including direct/co-investments and secondaries. The investment opportunity set has effectively doubled over the past decade, as illustrated in the chart below.

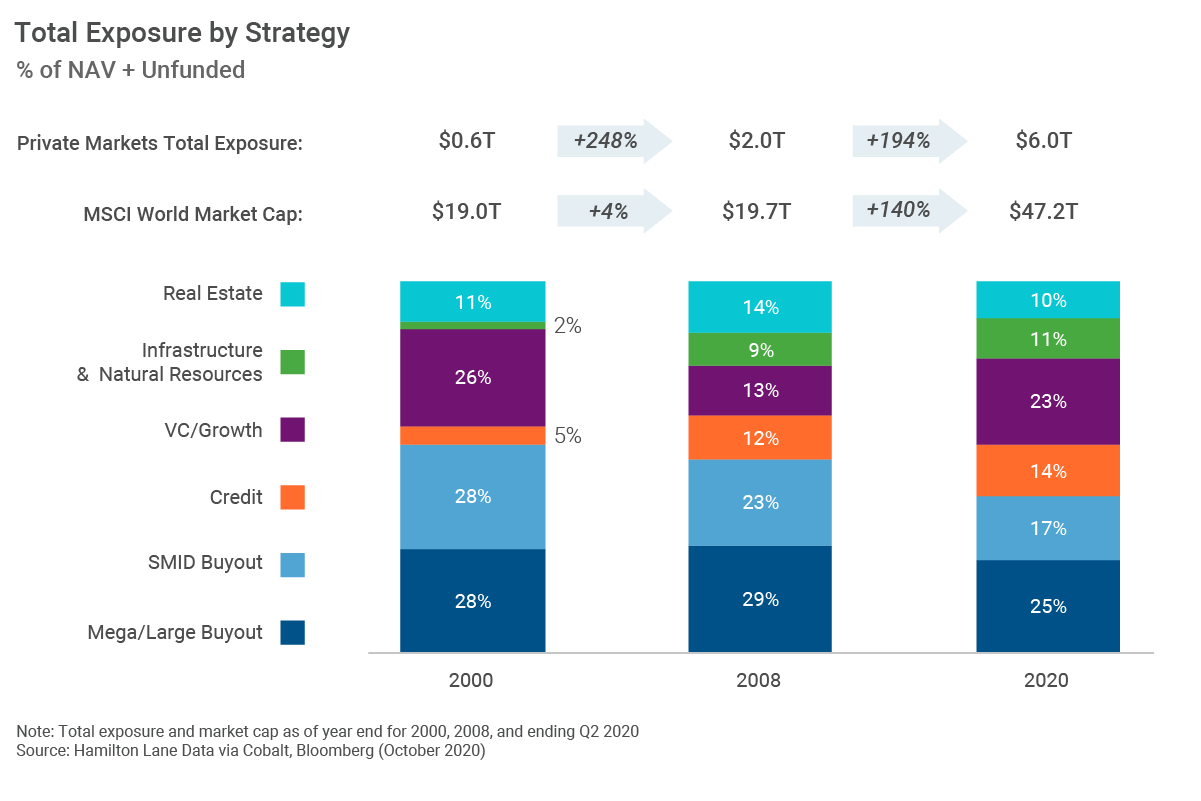

This broader opportunity set is evident not only in the number of available investment types, but also in the breadth of strategies. Don’t worry, I’ll spare you another ice cream analogy here - but you get the picture.

The plethora of opportunities increasingly allows investors to shape their portfolios in line with their own investment views or objectives. (Did the word “plethora” get anyone else thinking about Three Amigos?) Interestingly, market data and investor sentiment together point to some emerging trends in the ways that investors are shaping their portfolios.

As we noted in our Market Overview, “Certain sectors are proving particularly interesting to investors, and portfolios will increasingly tilt to more direct deals with more of a growth orientation and with increased real asset exposure.”

There is a lot to unpack there, so it’s instructive to examine the various pieces. Direct deals, or co-investments, continue to be broadly of interest to LPs. Co-investments offer LPs a way to work more closely with select managers, average down overall costs (co-investments are often done on a reduced or no-fee basis) and gain more targeted exposure into sectors or assets of their choosing. Single-asset secondary direct investments have similar characteristics, and are appealing for the same reasons.

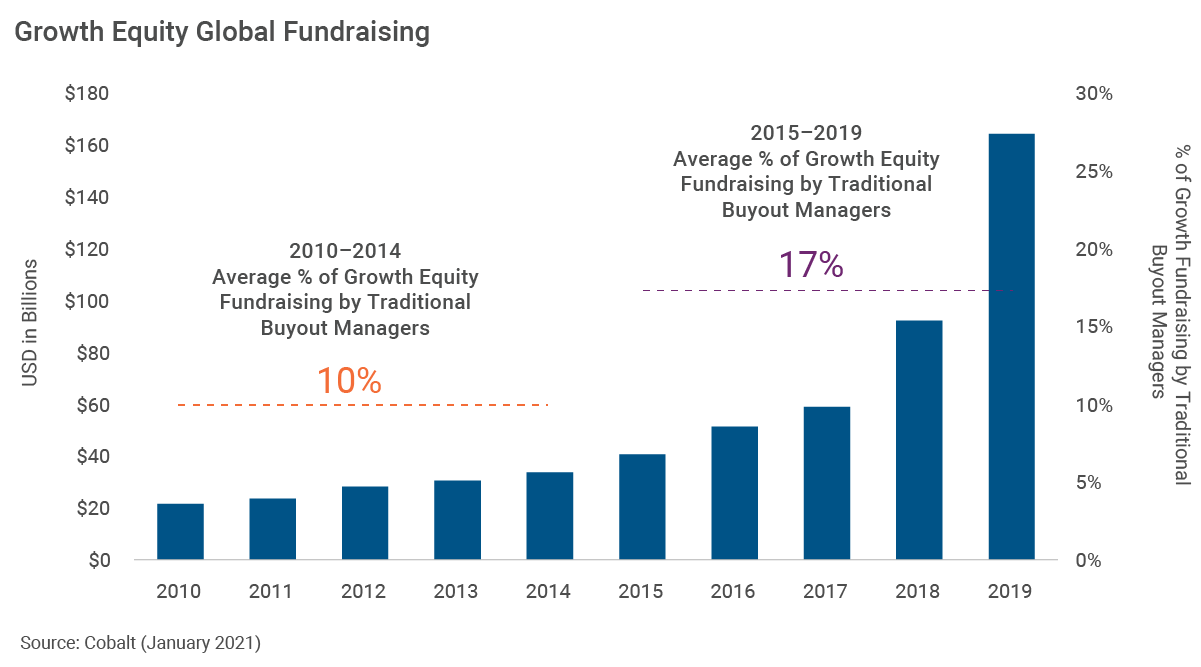

Two other strategies that were gaining investor attention in recent years saw accelerated mindshare in 2020: Growth equity and infrastructure. Growth equity has emerged as a rising star in the private markets in recent years; just look at the dramatic rise in growth equity fundraising in the chart below.

For fear of including too many charts in this piece, I am not including one on growth equity performance, so you will have to take my word for it (or read about it in our 2021 Market Overview). In my opinion, it’s really, really good.

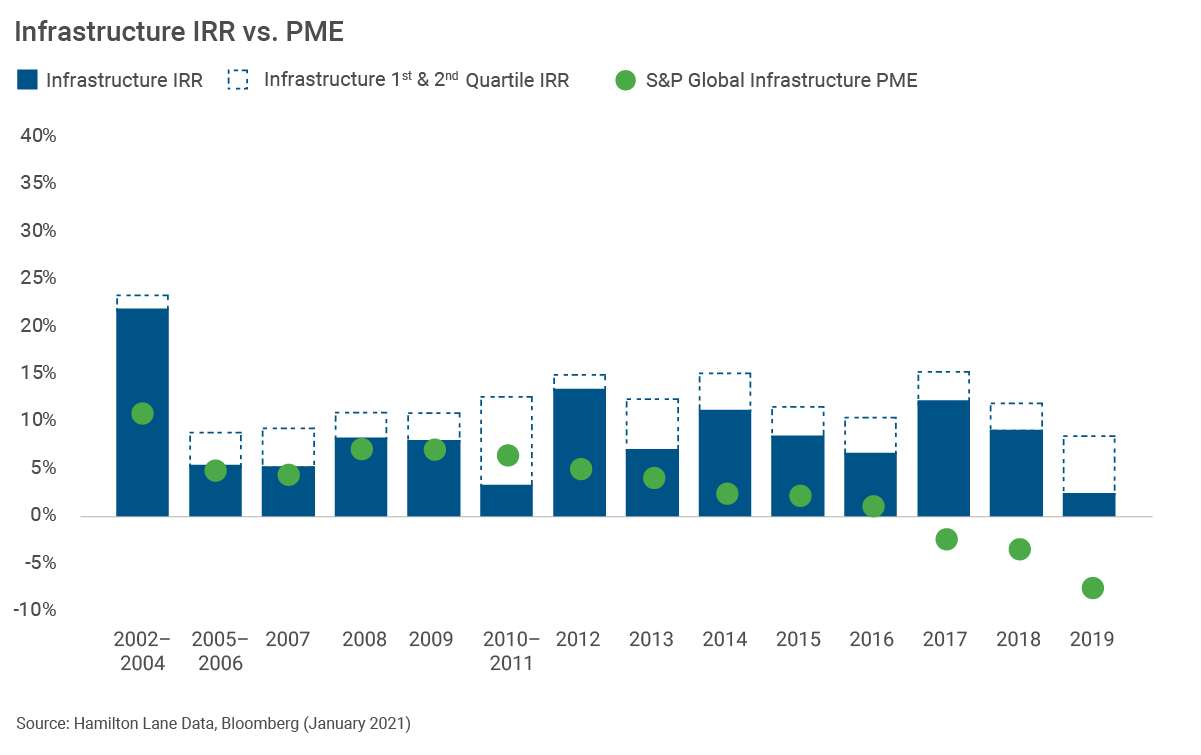

Likewise, infrastructure has been a growing part of the private markets in recent years. Investors like the stability, yield and potential inflation hedge offered by real assets. Significant outperformance compared to the public benchmarks for the better part of the past decade doesn’t hurt, either. I recognize that readers might be willing to trust one reference to performance without needing to see it with their own eyes, but two is probably a bridge too far.

While new deal activity paused in the first half of 2020, it rebounded strongly in the back half of the year, with new transactions focused almost exclusively on companies that had performed well through the pandemic. Growth-oriented assets and infrastructure (data centers, broadband and electrification) fared particularly well, reinforcing investor conviction in these areas. Co-investing allowed LPs to add targeted exposure into sectors that were performing well, and to do so with conviction that the investments were well-suited for the current environment, at a time when evaluating sectors that have been impacted was much more difficult. In 2020, Hamilton Lane received over 700 direct investment opportunities – our highest number on record. The high-volume direct investment activity, focused on strong performing sectors and companies, is enabling LPs to increase exposure to growth and infrastructure.

I’m personally a mint chocolate chip fan, but there’s a lot to like about a scoop or two of ice cream, no matter the flavor. Opportunities are out there to be had for those who know where to look – and while we’re talking about direct deals, growth equity and infrastructure today, it’s anyone’s guess as to what will be served up next.

STRATEGY DEFINITIONS

All Private Markets: Hamilton Lane’s definition of “All Private Markets” includes all private commingled funds excluding fund-of-funds, and secondary fund-of-funds.

Growth Equity: Any PM fund that focuses on providing growth capital through an equity investment.

Infrastructure: An investment strategy that invests in physical systems involved in the distribution of people, goods, and resources.

Mega/Large Buyout: Any buyout fund larger than a certain fund size that depends on the vintage year.

Natural Resources: An investment strategy that invests in companies involved in the extraction, refinement, or distribution of natural resources.

Real Assets: Real Assets includes any PM fund with a strategy of Infrastructure, Natural Resources, or Real Estate.

SMID Buyout: Any buyout fund smaller than a certain fund size, dependent on vintage year.

VC/Growth: Includes all funds with a strategy of venture capital or growth equity.

INDEX DEFINITIONS

MSCI World Index: The MSCI World Index tracks large and mid-cap equity performance in developed market countries.

S&P Global Infrastructure Index: The S&P Global Infrastructure Index tracks the performance of 75 companies from around the world that represent the infrastructure industry.

DISCLOSURES

This presentation has been prepared solely for informational purposes and contains confidential and proprietary information, the disclosure of which could be harmful to Hamilton Lane. Accordingly, the recipients of this presentation are requested to maintain the confidentiality of the information contained herein. This presentation may not be copied or distributed, in whole or in part, without the prior written consent of Hamilton Lane.

The information contained in this presentation may include forward-looking statements regarding returns, performance, opinions, the fund presented or its portfolio companies, or other events contained herein. Forward-looking statements include a number of risks, uncertainties and other factors beyond our control, or the control of the fund or the portfolio companies, which may result in material differences in actual results, performance or other expectations. The opinions, estimates and analyses reflect our current judgment, which may change in the future.

All opinions, estimates and forecasts of future performance or other events contained herein are based on information available to Hamilton Lane as of the date of this presentation and are subject to change. Past performance of the investments described herein is not indicative of future results. In addition, nothing contained herein shall be deemed to be a prediction of future performance. The information included in this presentation has not been reviewed or audited by independent public accountants. Certain information included herein has been obtained from sources that Hamilton Lane believes to be reliable, but the accuracy of such information cannot be guaranteed.

This presentation is not an offer to sell, or a solicitation of any offer to buy, any security or to enter into any agreement with Hamilton Lane or any of its affiliates. Any such offering will be made only at your request. We do not intend that any public offering will be made by us at any time with respect to any potential transaction discussed in this presentation. Any offering or potential transaction will be made pursuant to separate documentation negotiated between us, which will supersede entirely the information contained herein.

Certain of the performance results included herein do not reflect the deduction of any applicable advisory or management fees, since it is not possible to allocate such fees accurately in a vintage year presentation or in a composite measured at different points in time. A client’s rate of return will be reduced by any applicable advisory or management fees, carried interest and any expenses incurred. Hamilton Lane’s fees are described in Part 2 of our Form ADV, a copy of which is available upon request.

The following hypothetical example illustrates the effect of fees on earned returns for both separate accounts and fund-of-funds investment vehicles. The example is solely for illustration purposes and is not intended as a guarantee or prediction of the actual returns that would be earned by similar investment vehicles having comparable features. The example is as follows: The hypothetical separate account or fund-of-funds consisted of $100 million in commitments with a fee structure of 1.0% on committed capital during the first four years of the term of the investment and then declining by 10% per year thereafter for the 12-year life of the account. The commitments were made during the first three years in relatively equal increments and the assumption of returns was based on cash flow assumptions derived from a historical database of actual private equity cash flows. Hamilton Lane modeled the impact of fees on four different return streams over a 12-year time period. In these examples, the effect of the fees reduced returns by approximately 2%. This does not include performance fees, since the performance of the account would determine the effect such fees would have on returns. Expenses also vary based on the particular investment vehicle and, therefore, were not included in this hypothetical example. Both performance fees and expenses would further decrease the return.

Hamilton Lane (Germany) GmbH is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (Germany) GmbH is authorised and regulated by the Federal Financial Supervisory Authority (BaFin). In the European Economic Area this communication is directed solely at persons who would be classified as professional investors within the meaning of Directive 2011/61/EU (AIFMD). Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients.

Hamilton Lane (UK) Limited is a wholly-owned subsidiary of Hamilton Lane Advisors, L.L.C. Hamilton Lane (UK) Limited is authorised and regulated by the Financial Conduct Authority (FCA). In the United Kingdom this communication is directed solely at persons who would be classified as a professional client or eligible counterparty under the FCA Handbook of Rules and Guidance. Its contents are not directed at, may not be suitable for and should not be relied upon by retail clients.

Hamilton Lane Advisors, L.L.C. is exempt from the requirement to hold an Australian financial services licence under the Corporations Act 2001 in respect of the financial services by operation of ASIC Class Order 03/1100: U.S. SEC regulated financial service providers. Hamilton Lane Advisors, L.L.C. is regulated by the SEC under U.S. laws, which differ from Australian laws.

Any tables, graphs or charts relating to past performance included in this presentation are intended only to illustrate the performance of the indices, composites, specific accounts or funds referred to for the historical periods shown. Such tables, graphs and charts are not intended to predict future performance and should not be used as the basis for an investment decision.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein.

The calculations contained in this document are made by Hamilton Lane based on information provided by the general partner (e.g. cash flows and valuations), and have not been prepared, reviewed or approved by the general partners.

As of May 19, 2021